Who Else Wants Info About Mileage Expense Report Template

Free downloadable and printable pdf mileage expense templates are available for your personal or business needs.

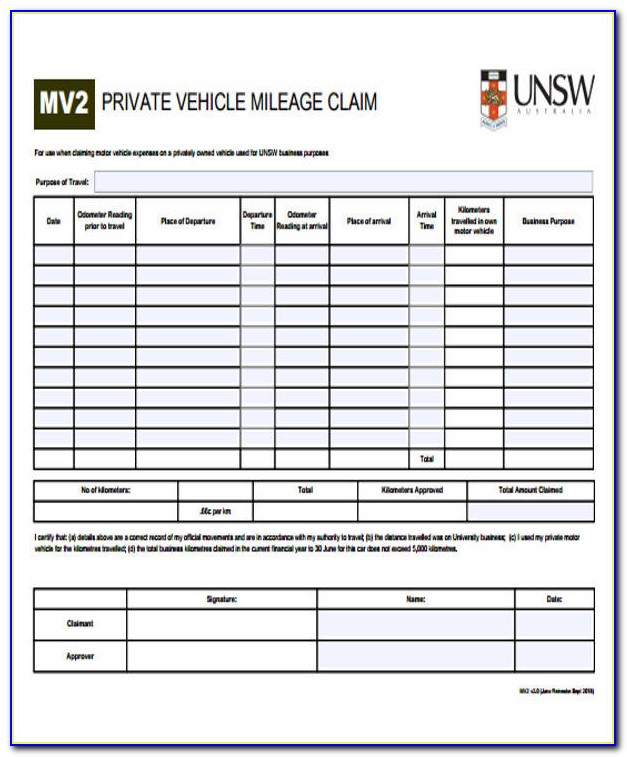

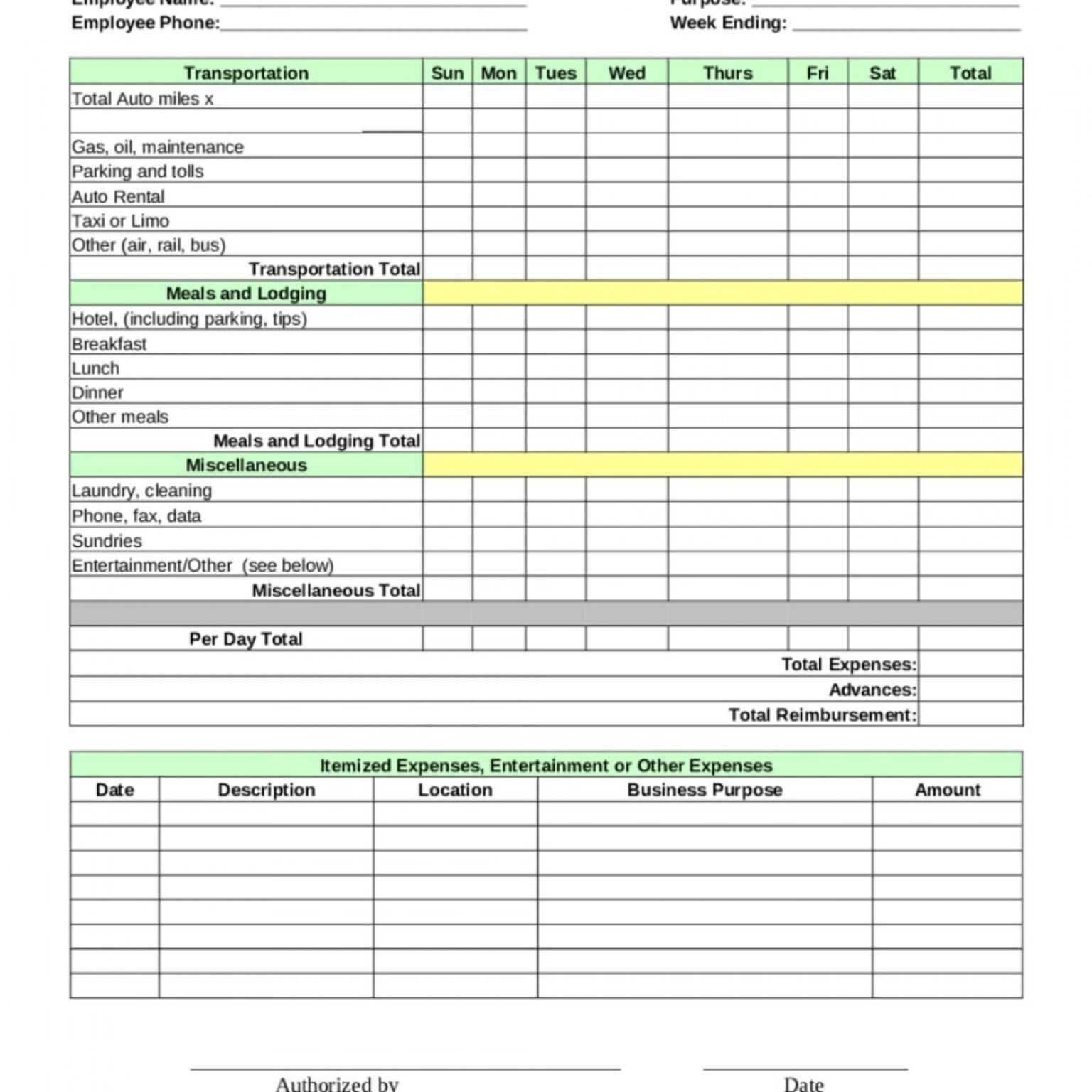

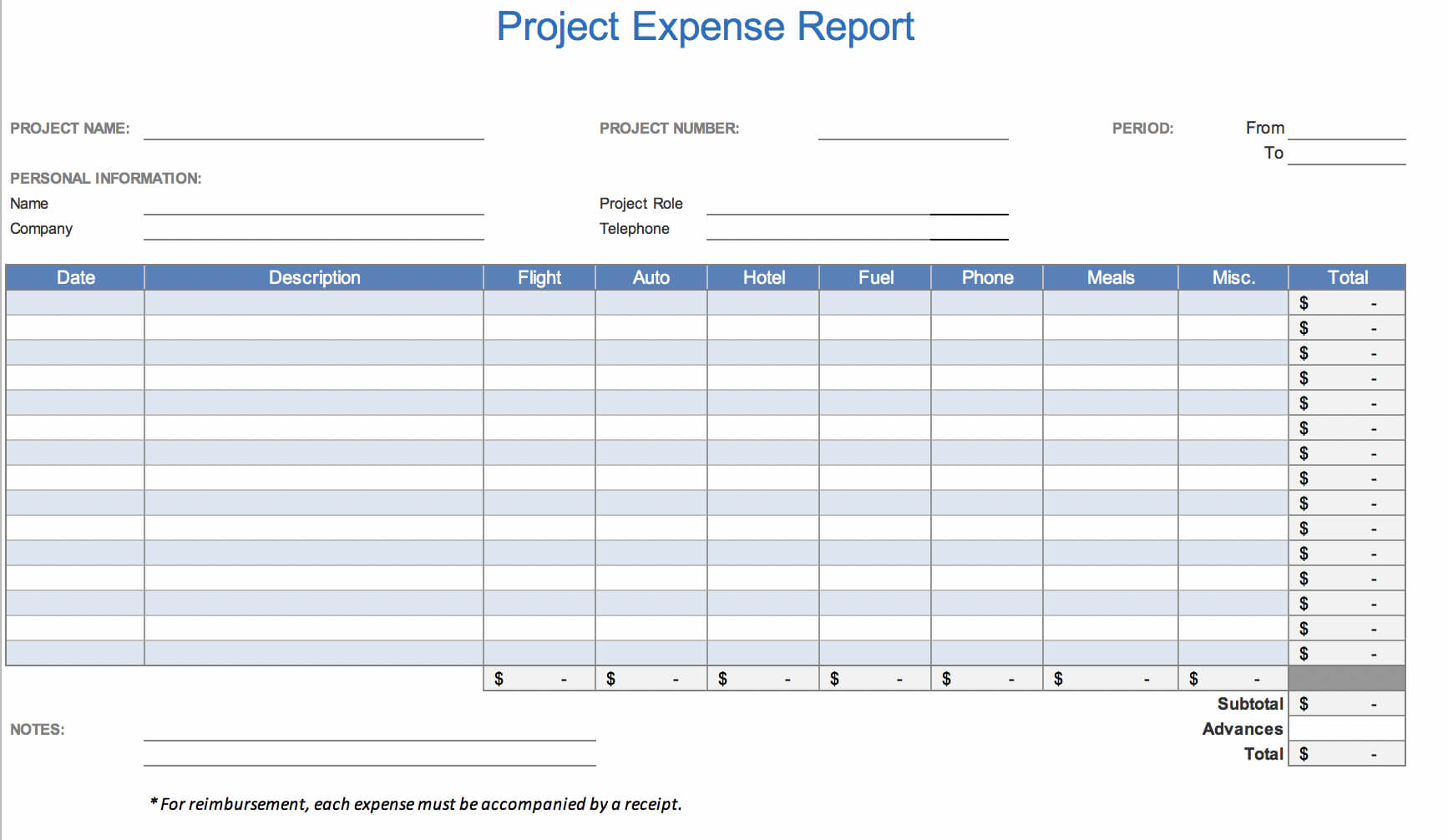

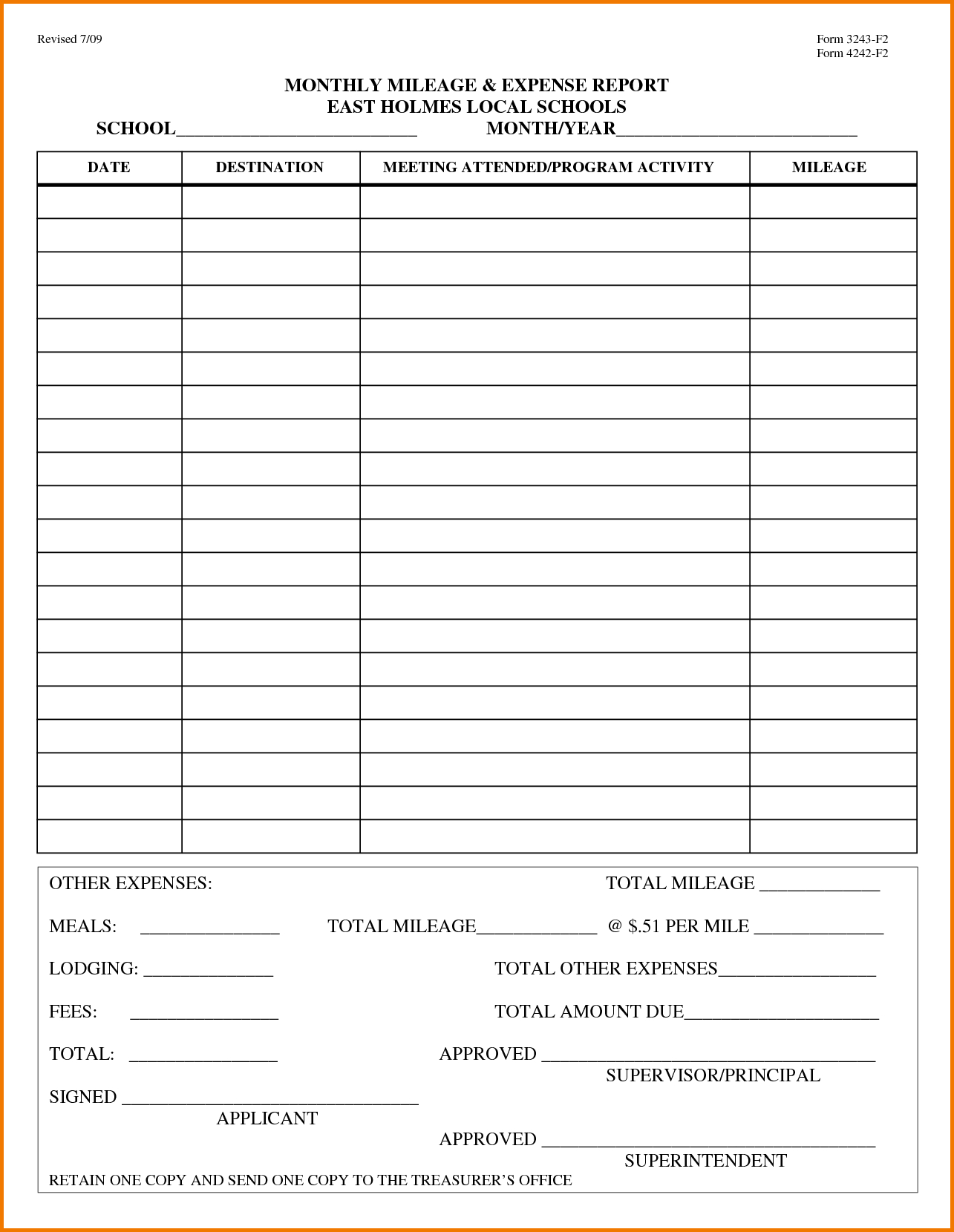

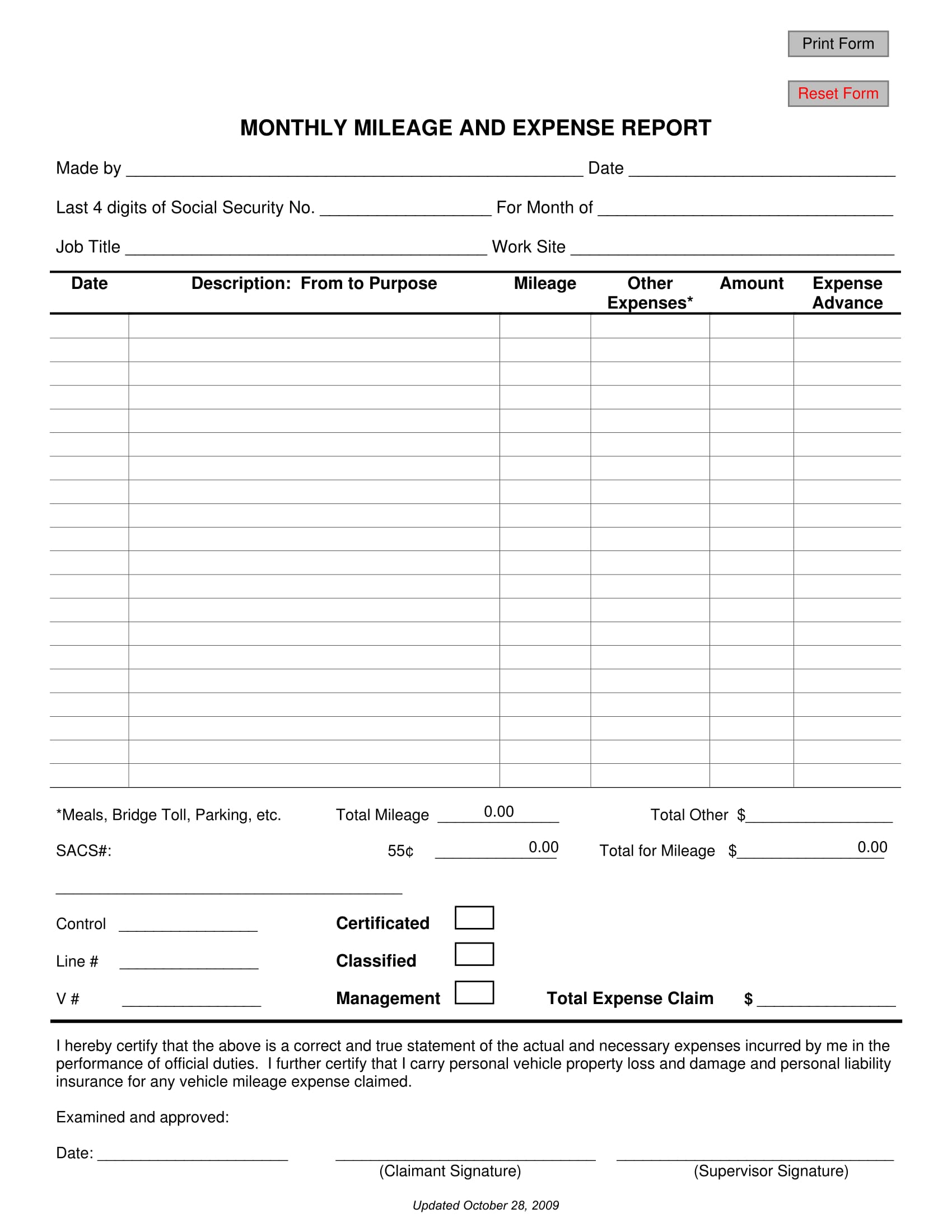

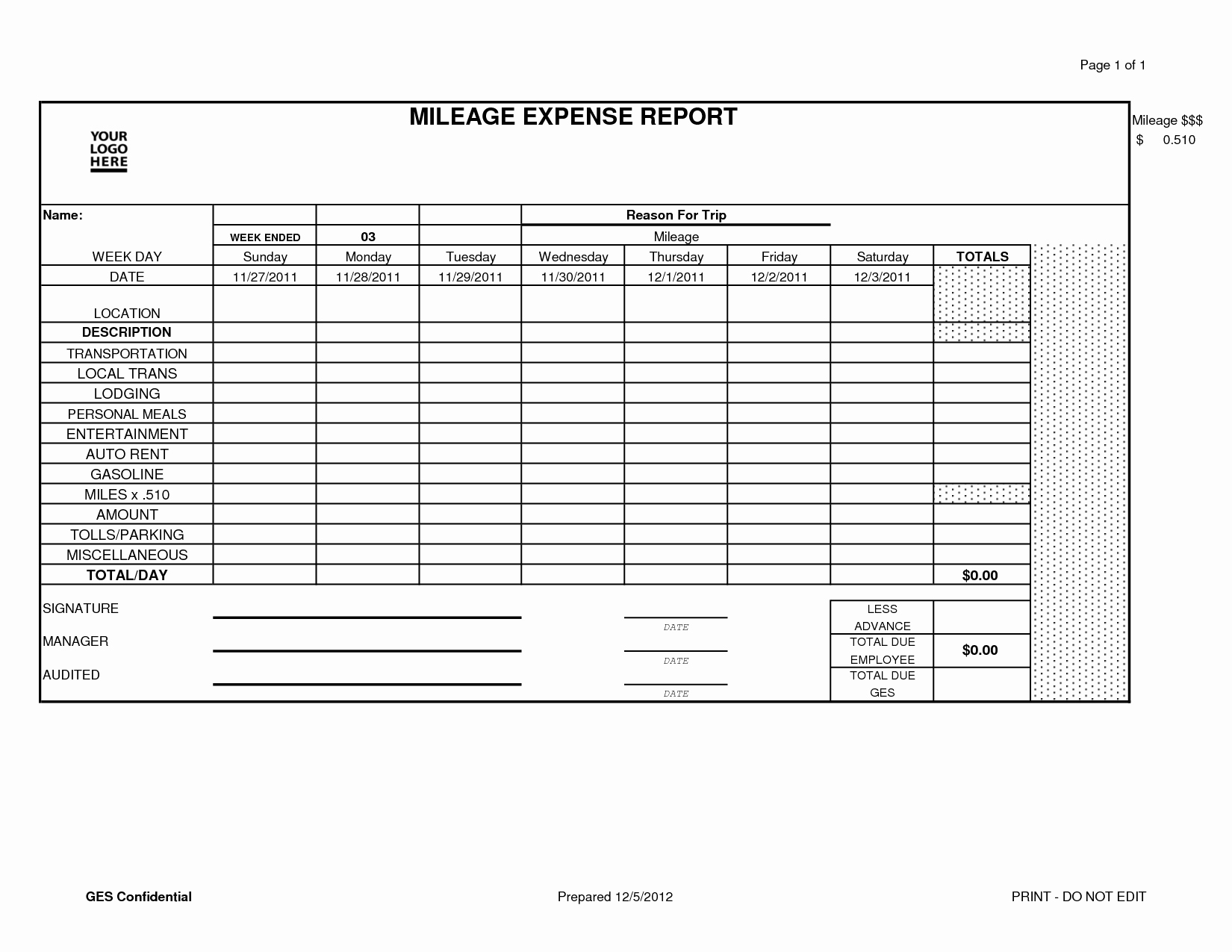

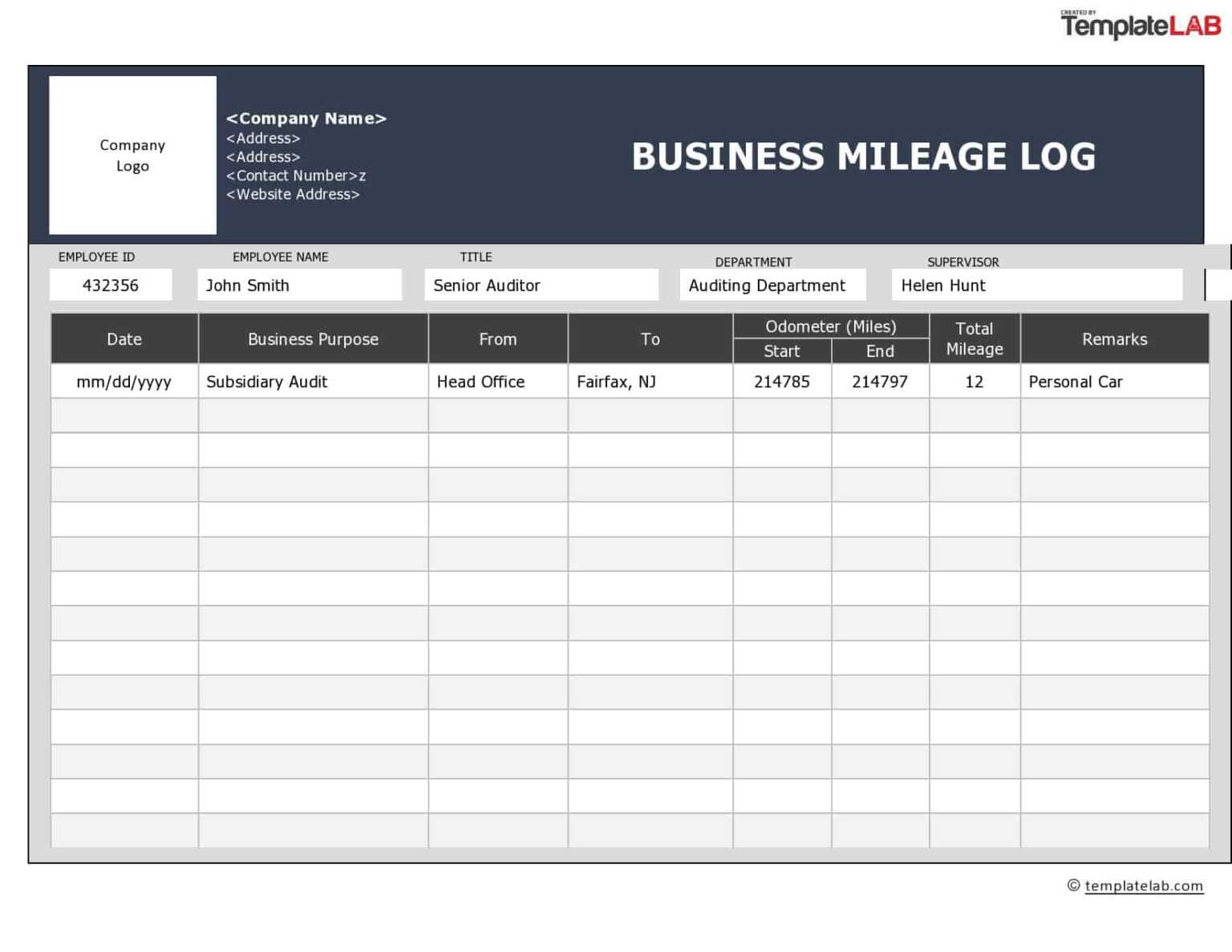

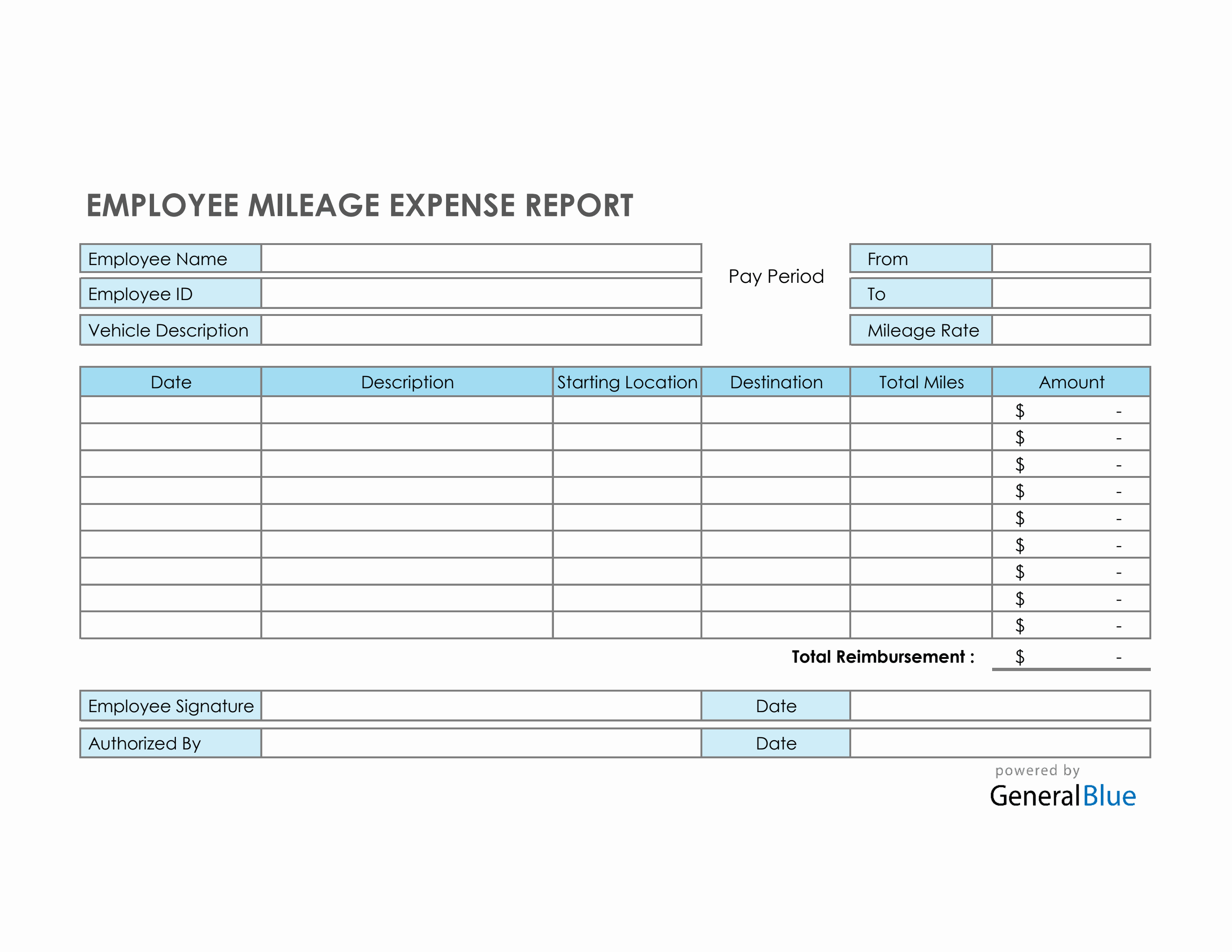

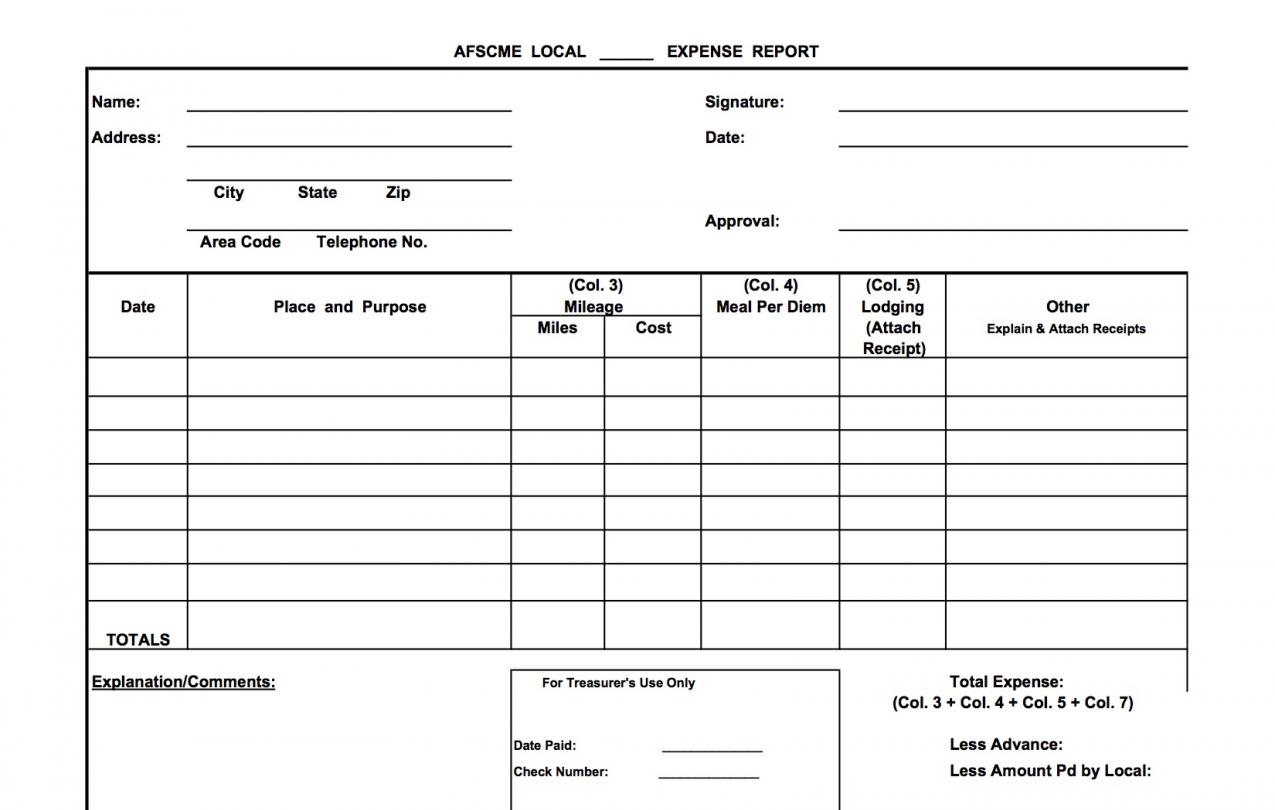

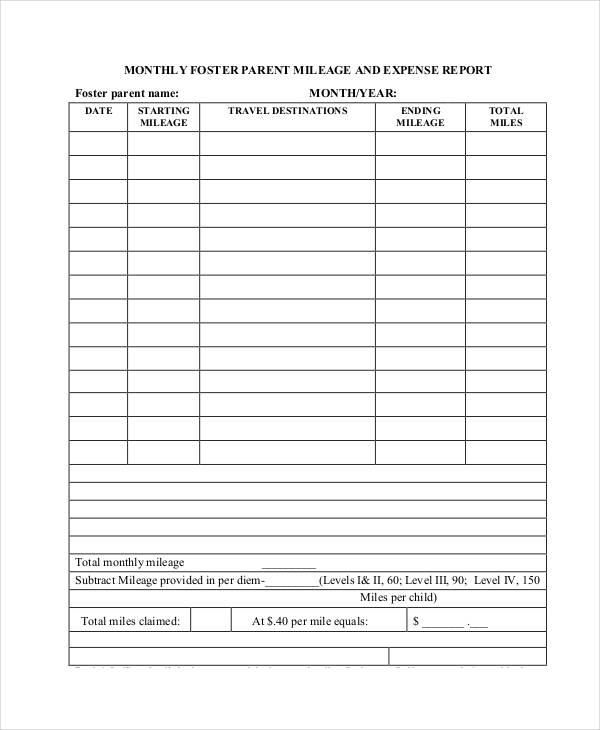

Mileage expense report template. This business mileage expense report lets you: In addition to monthly log sheets, the template provides an annual mileage summary so that you can get a quick. For employees whose traveling expenses are shouldered by their company, this mileage expense report in.

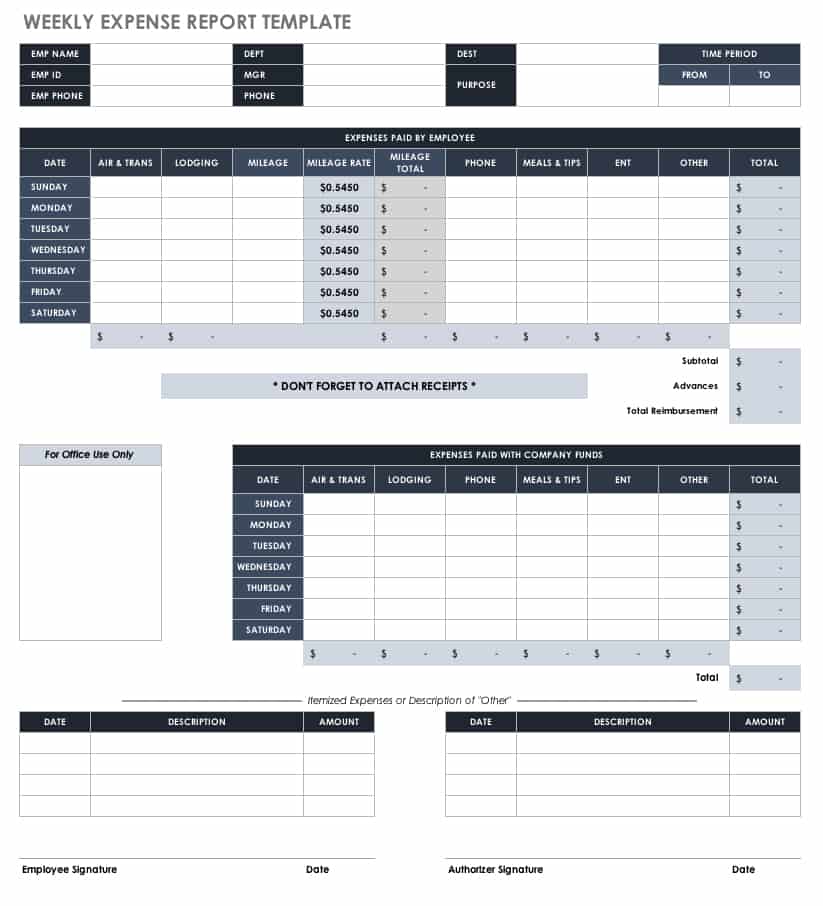

This mileage log and expense report excel template is a great way to keep track of your mileage and expenses for business or personal use. The mileage log and expense report template is here to help! What is the business mileage expense report template?

Use this free mileage log and expense report template to keep track of miles driven and calculate your expense report! Free pdf mileage expense templates. This can help you calculate your mileage.

Wrapping up what is a mileage log? In addition to keeping all your mileage and expense records in one place, everlance allows you to track your automotive expenses. Expense employee expense mileage expense blank per diem expense report template in excel (simple) get this free blank per diem.

The simple expense report template uses one column for all expense types. Mileage logs are logbooks or. Get started with this mileage log and expense report.

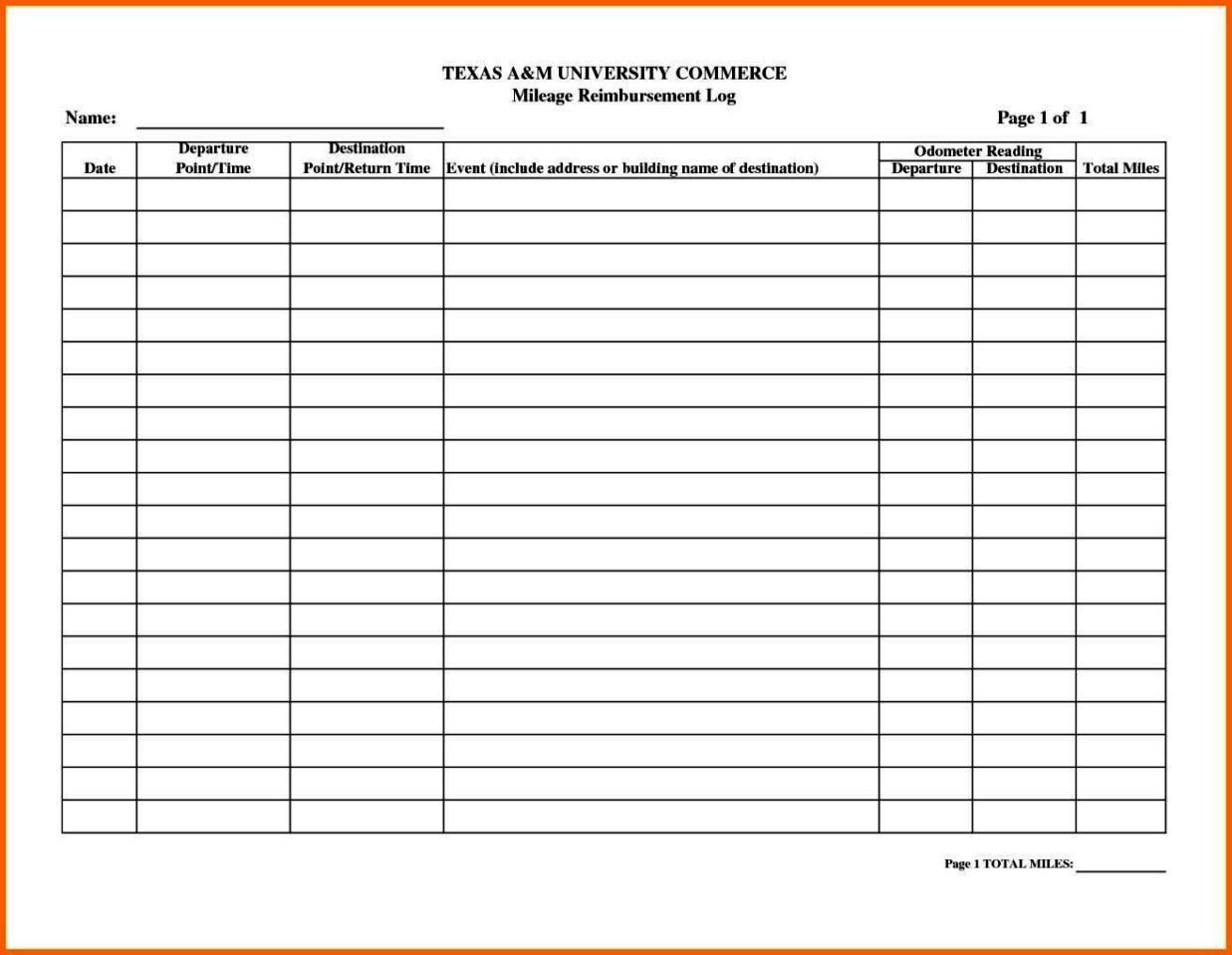

1 sheet for the mileage log, 12 monthly log sheets, 1 annual. Editable employee mileage expense report template in word. How do i keep track of business miles?

It’s free to download or print. Do you have to provide proof of mileage on taxes? Luckily, we have a mileage form template, which you can use to track your business expenses for mileage, you only need to download excel if you haven’t already,.

This employee mileage reimbursement template features sections for employee name, employee id, vehicle description, pay period, mileage rate, date, description, starting. Specify your starting place, destination, travel purpose, and;. Keep track of your overall mileage as well as business miles that can be deducted.