First Class Tips About Payback Period Formula Excel Template

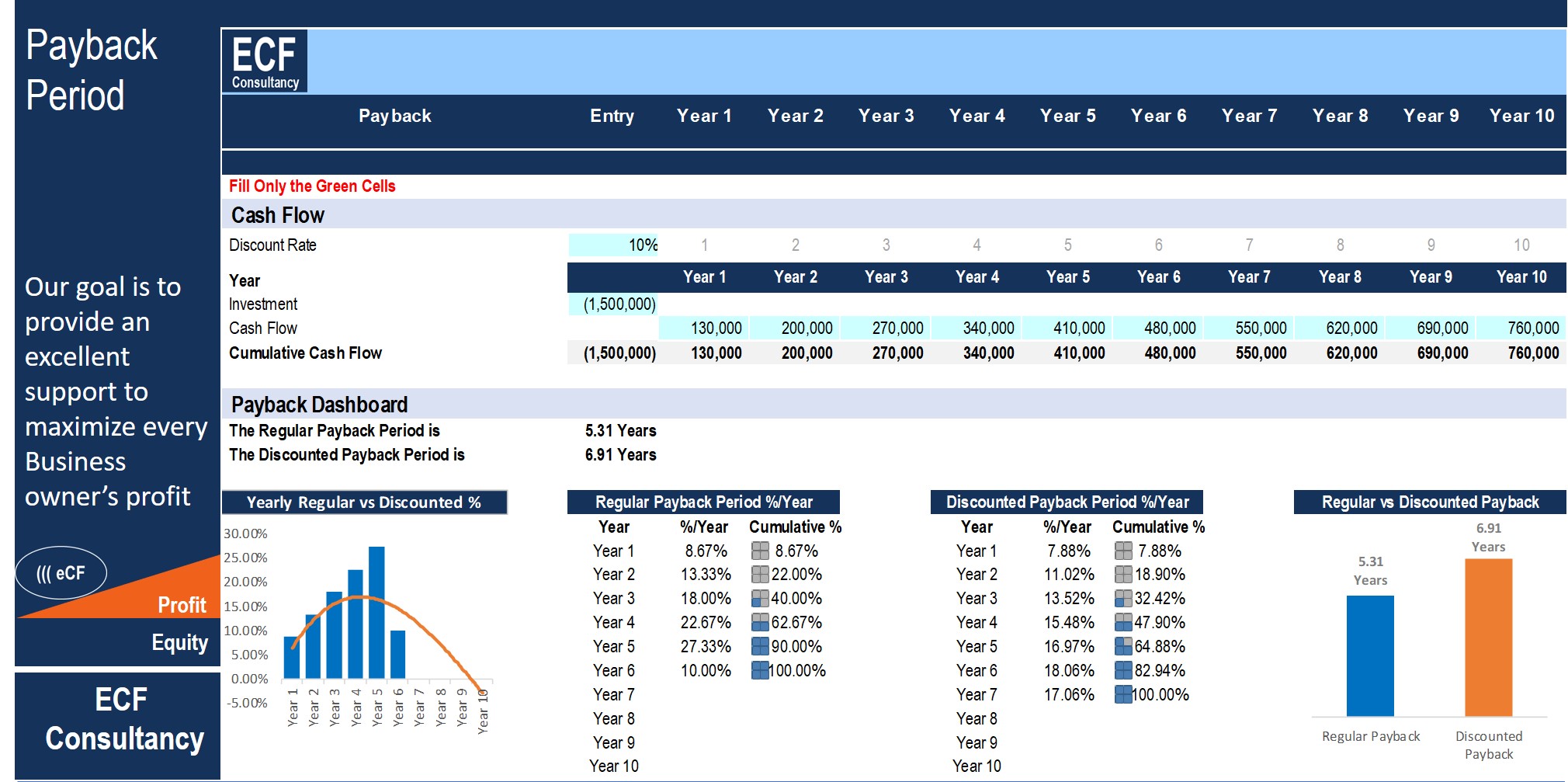

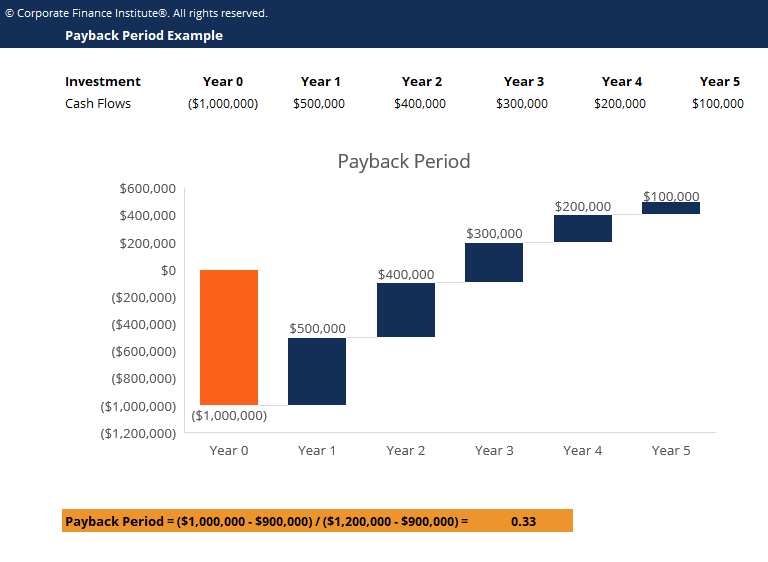

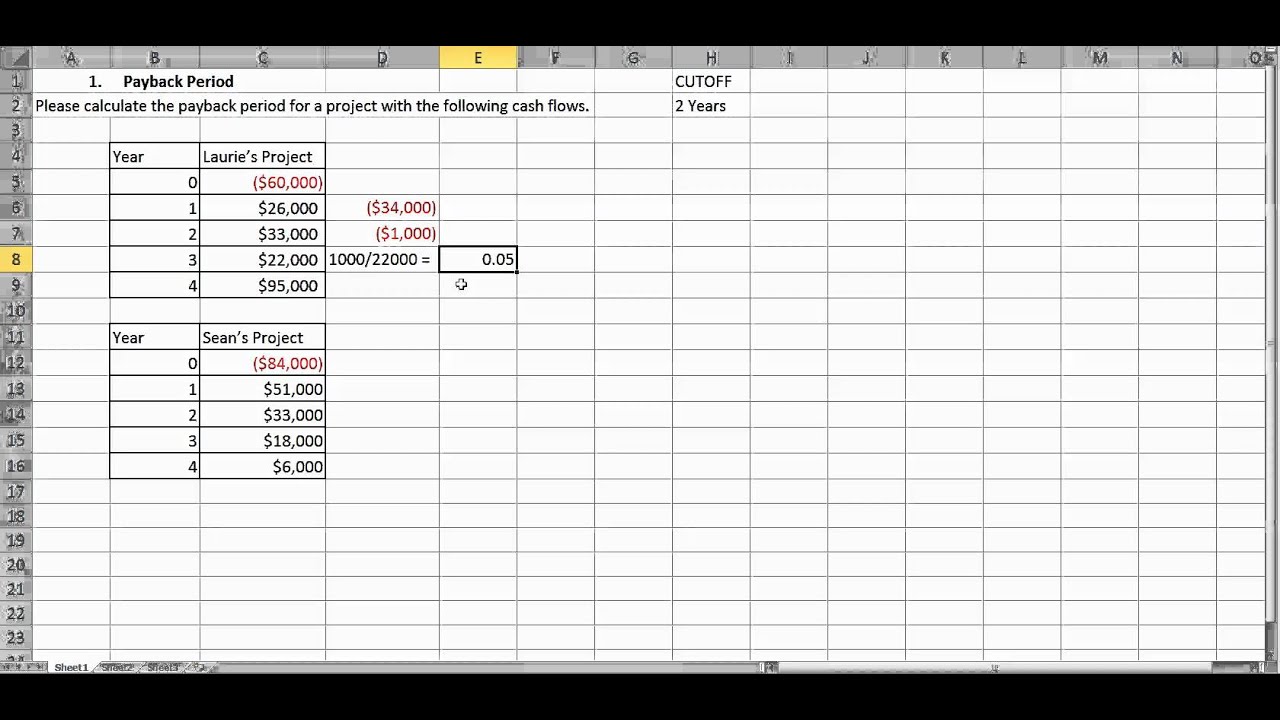

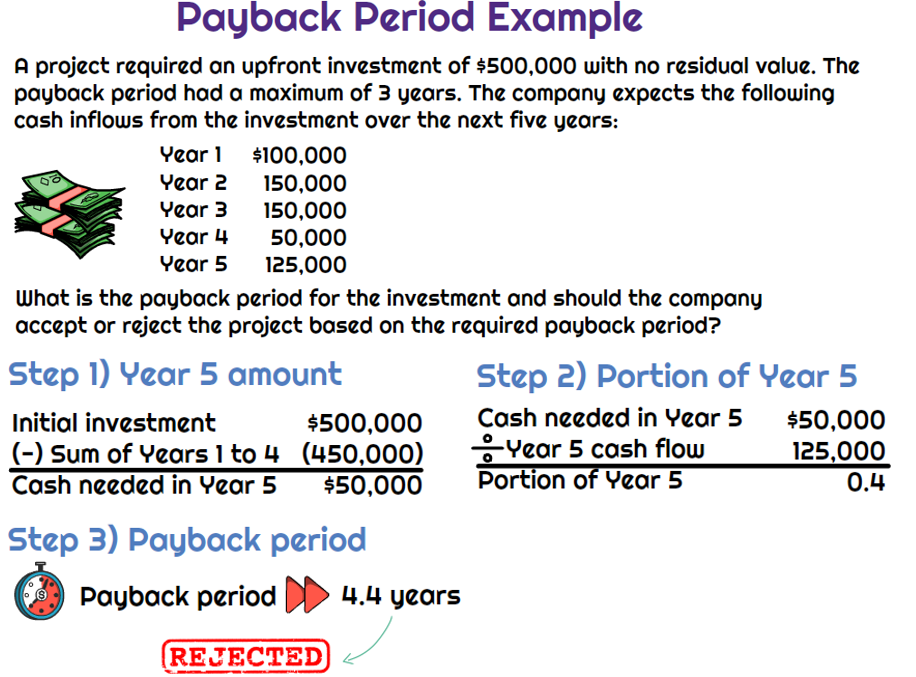

The formula for calculating the payback period is the initial investment divided by incoming cash flows.

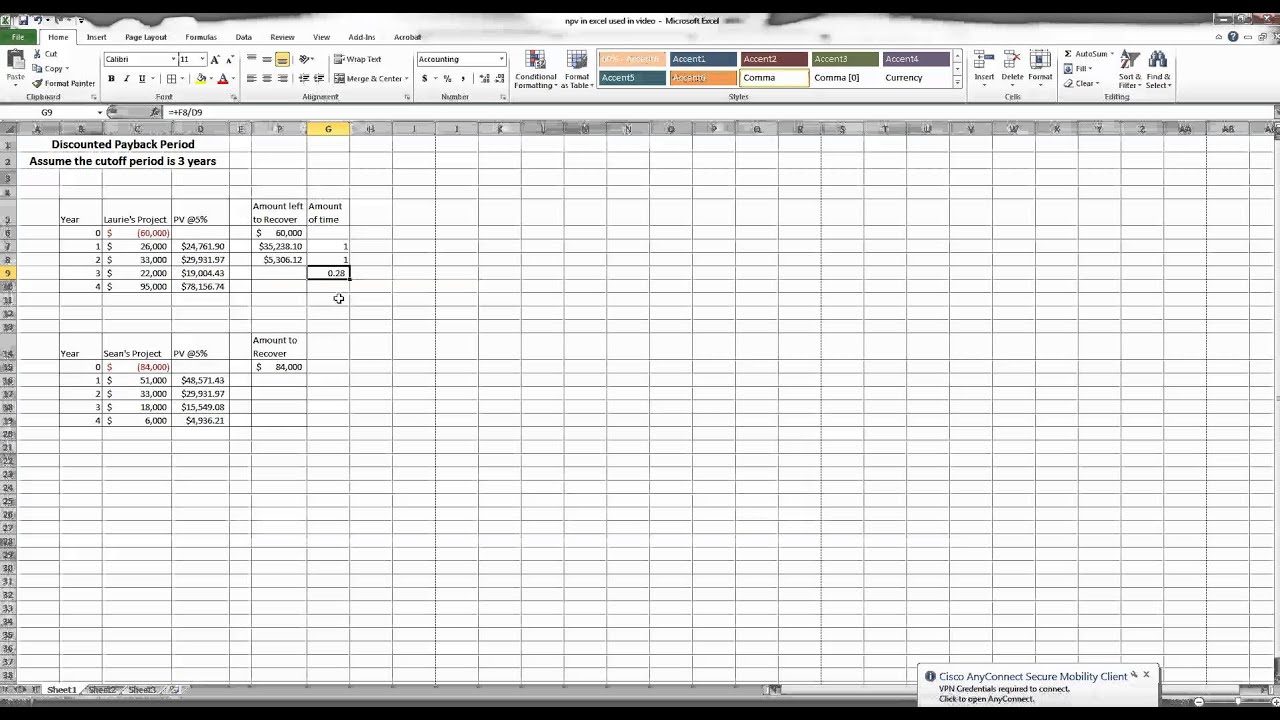

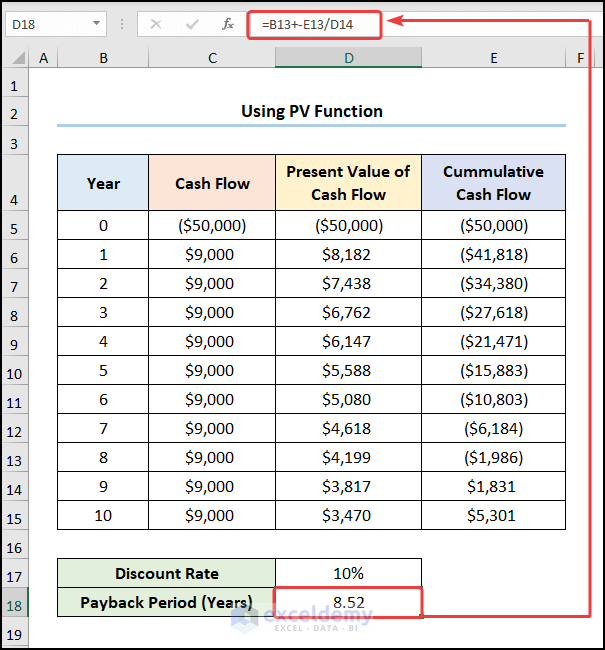

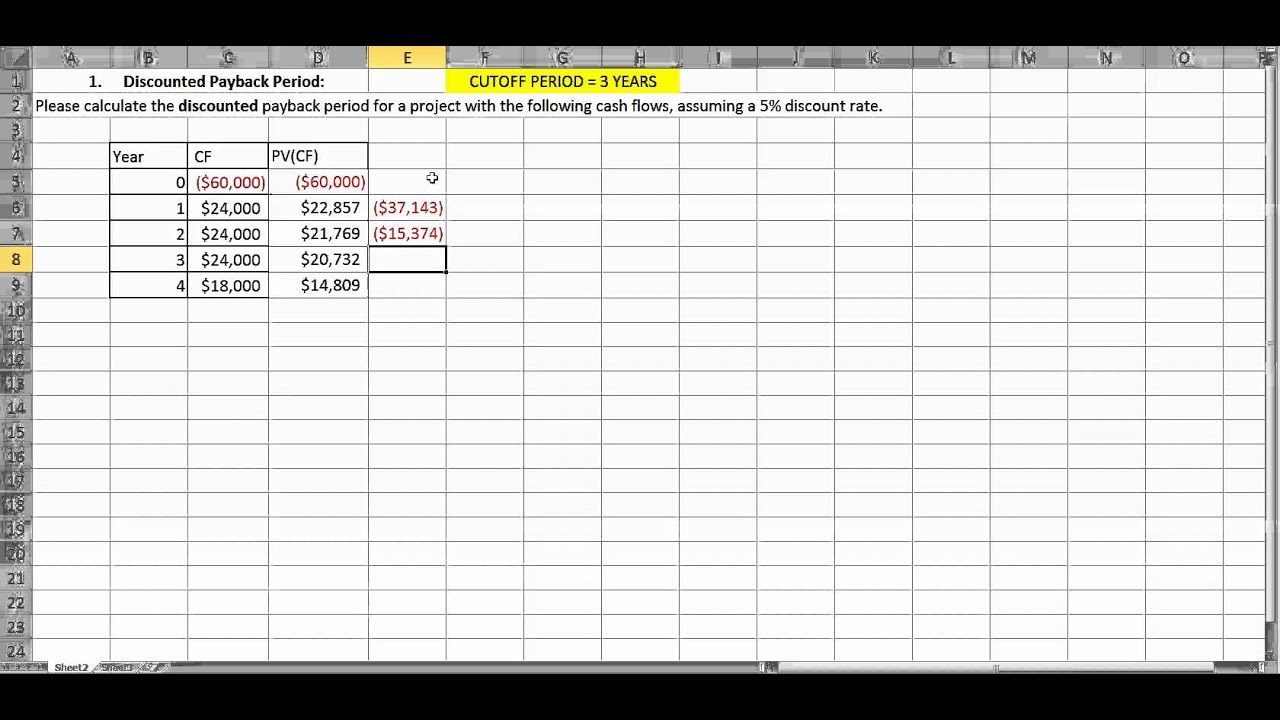

Payback period formula excel template. Payback period excel model templates | efinancialmodels payback period below, we listed the financial model templates for different industries which include a payback. If your data contains both cash inflows and cash outflows, calculate “net cash flow” or. How to calculate payback period the payback period is a fundamental capital budgeting tool in corporate finance, and perhaps the simplest method for.

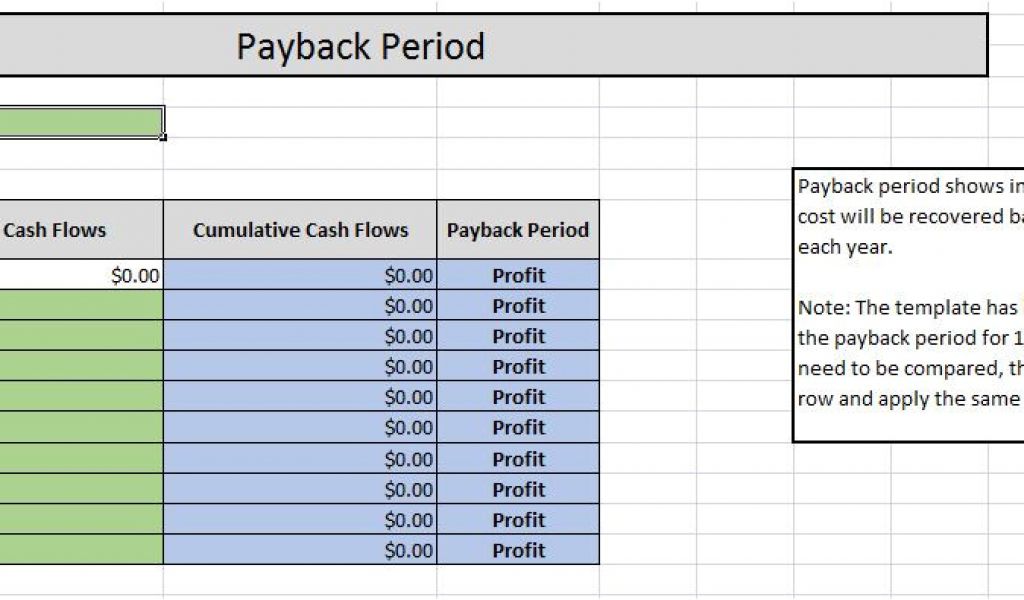

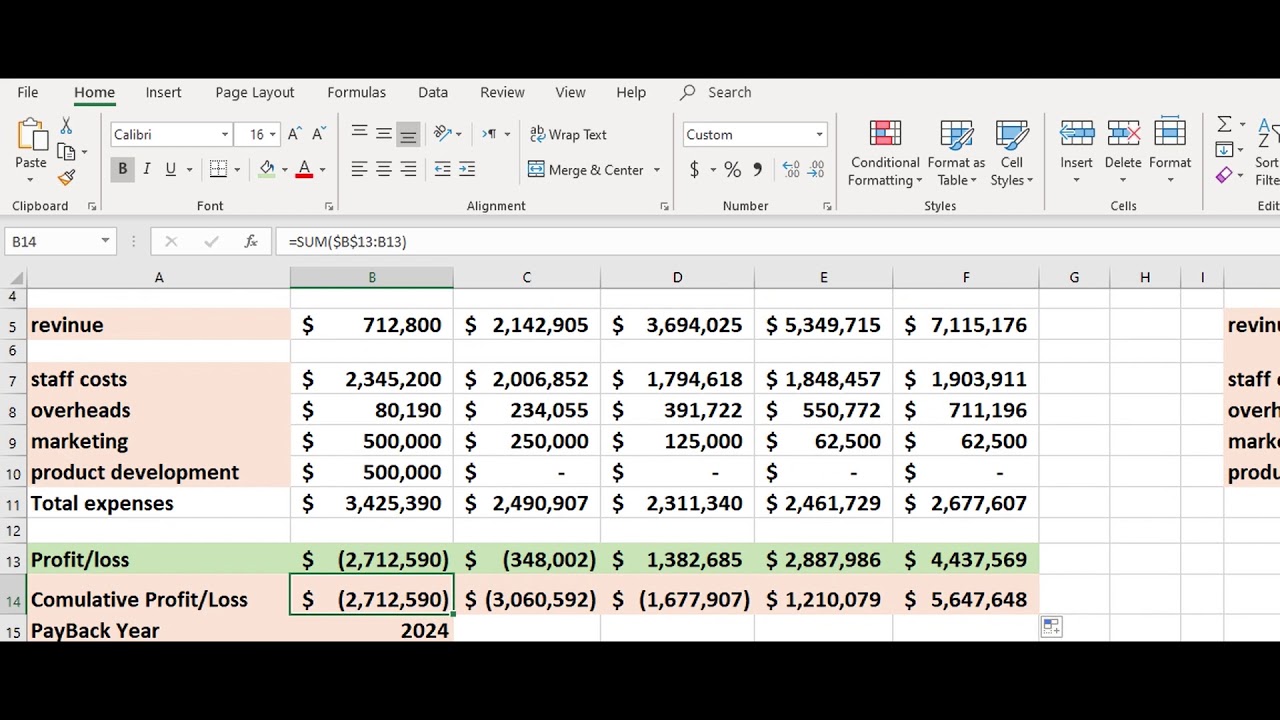

Payback period excel template to help you calculate the time required to recoup the initial investments. Calculating the payback period. This is the year in which you will have recouped your initial investment cost.

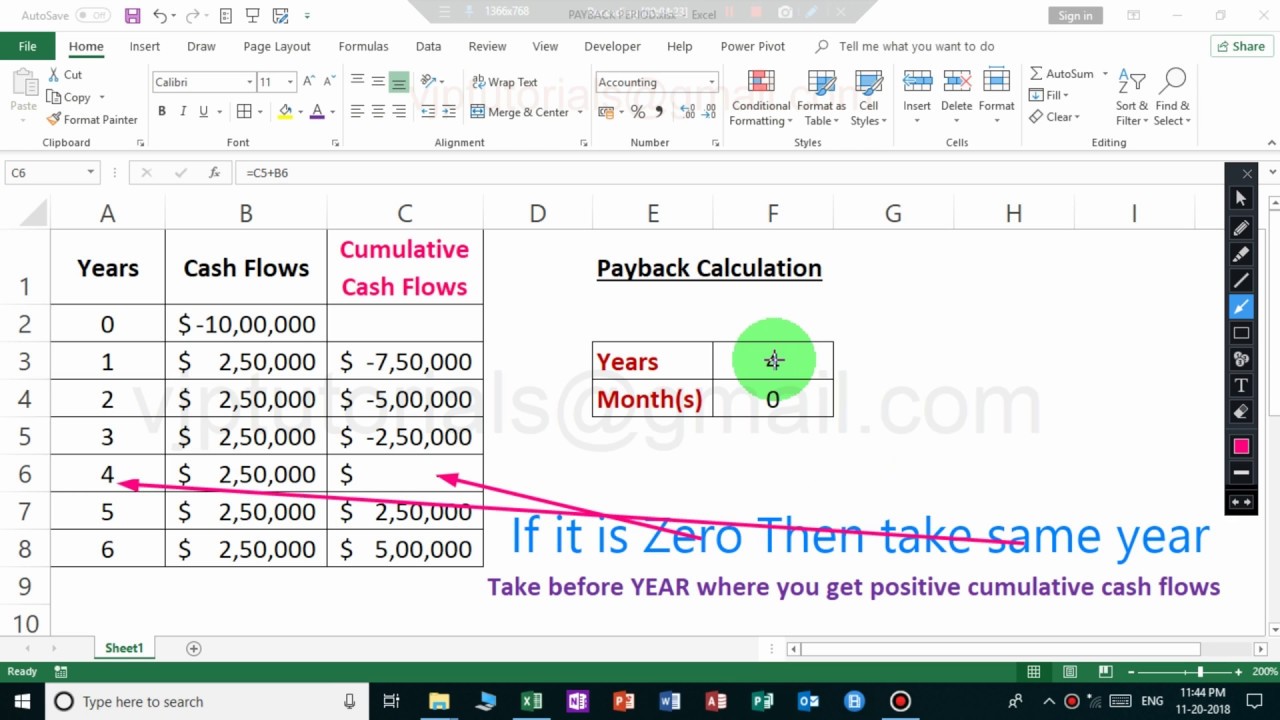

Build the dataset enter financial data in your excel worksheet. To calculate the payback period, you need two key pieces of information: Payback period = number of years− (cumulative cash inflow for the last complete year/cash inflow for the current year).

Types of payback period. By applying the payback period formula, we can determine the payback period for this investment. As a result, it’ll return a line chart as shown below.

You can calculate the payback period in excel by dividing the initial investment by annual cash flow or adding up variable yearly cash flows until they equal. Moreover, we can insert charts to get the payback period. Use this free template to analyze capital investments and.

The payback period is the length of time required to recover the cost of an investment. Use the payback period formula: Advantages and disadvantages of the payback period.

Choose the ranges b5:b10 and e5:e10at first. Guide how to calculate payback period in excel june 19, 2023 as a financial analyst, one of the key metrics you need to understand is the payback period. The integer this one is a simple.