Fabulous Tips About Simple Balance Sheet Excel

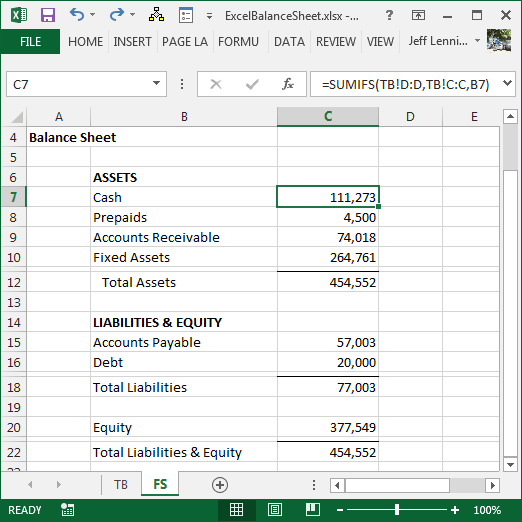

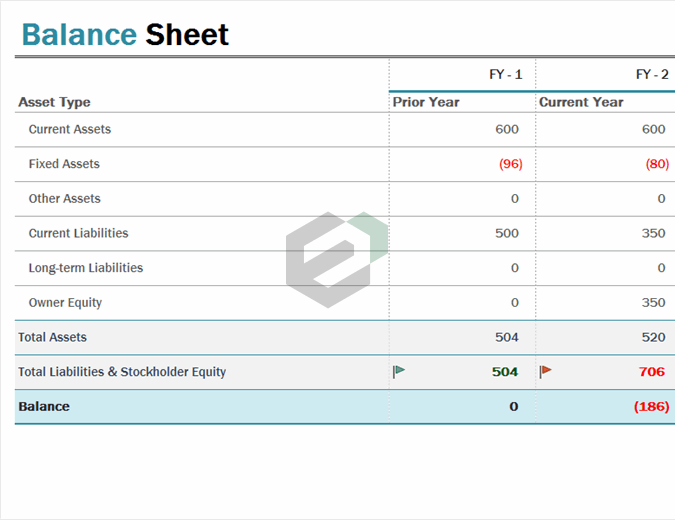

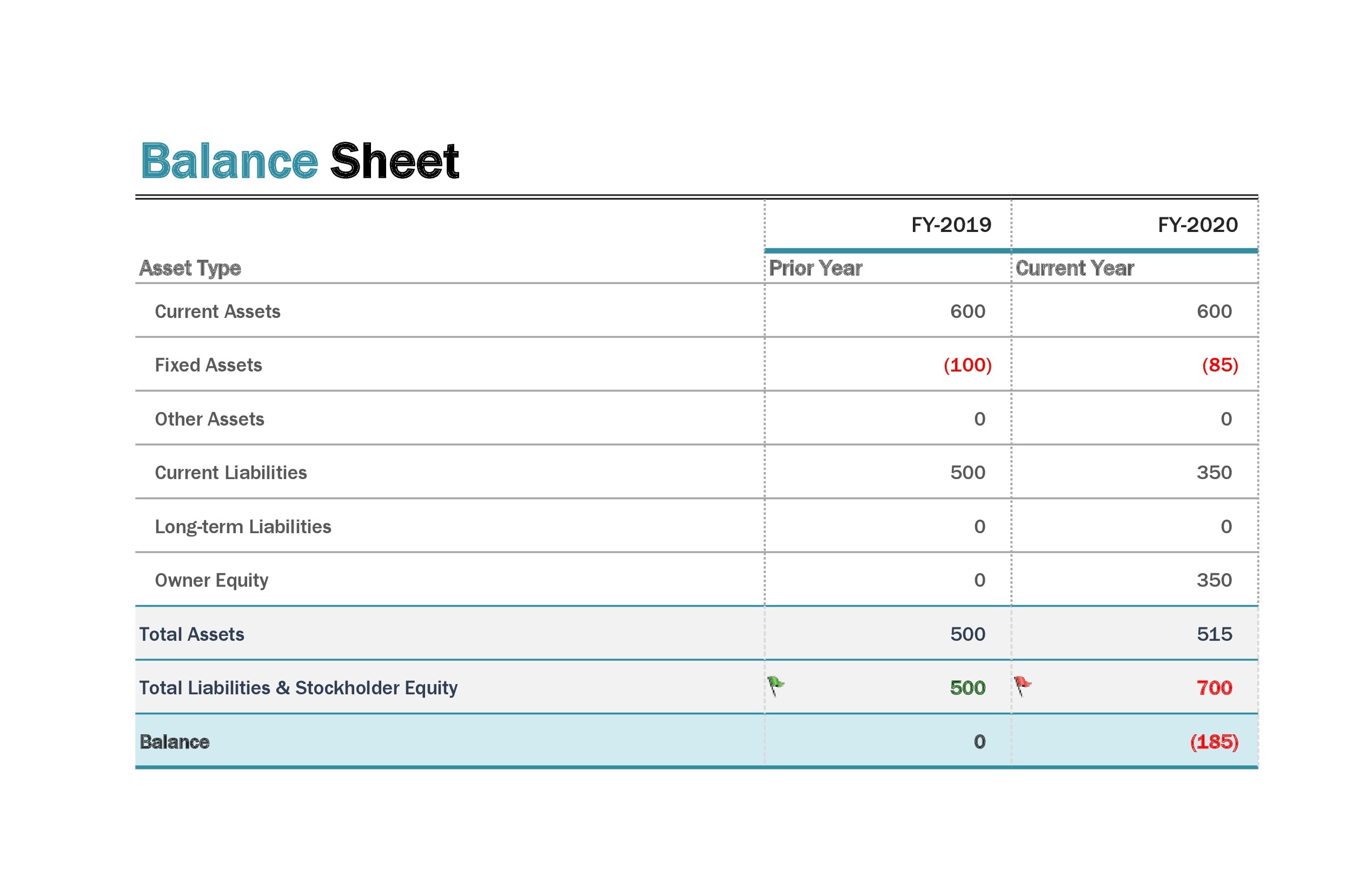

The balance sheet formula (assets = liabilities + shareholder equity) is the same regardless of the size or type of.

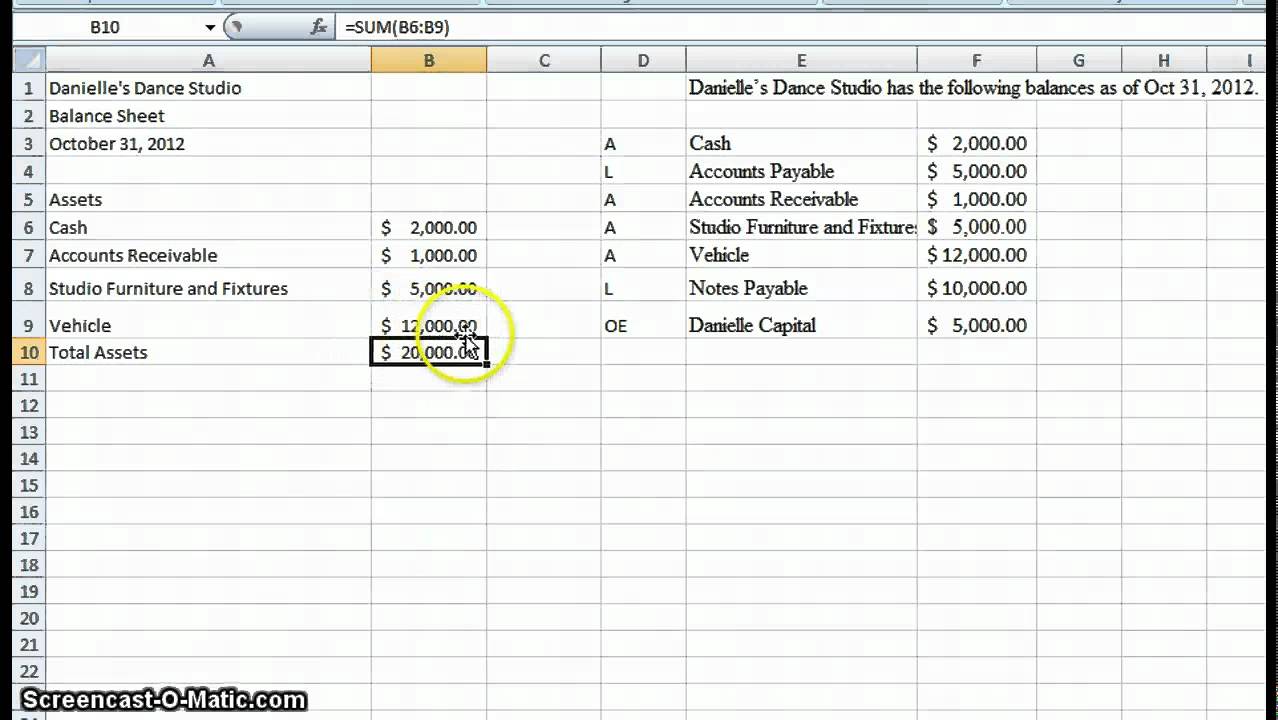

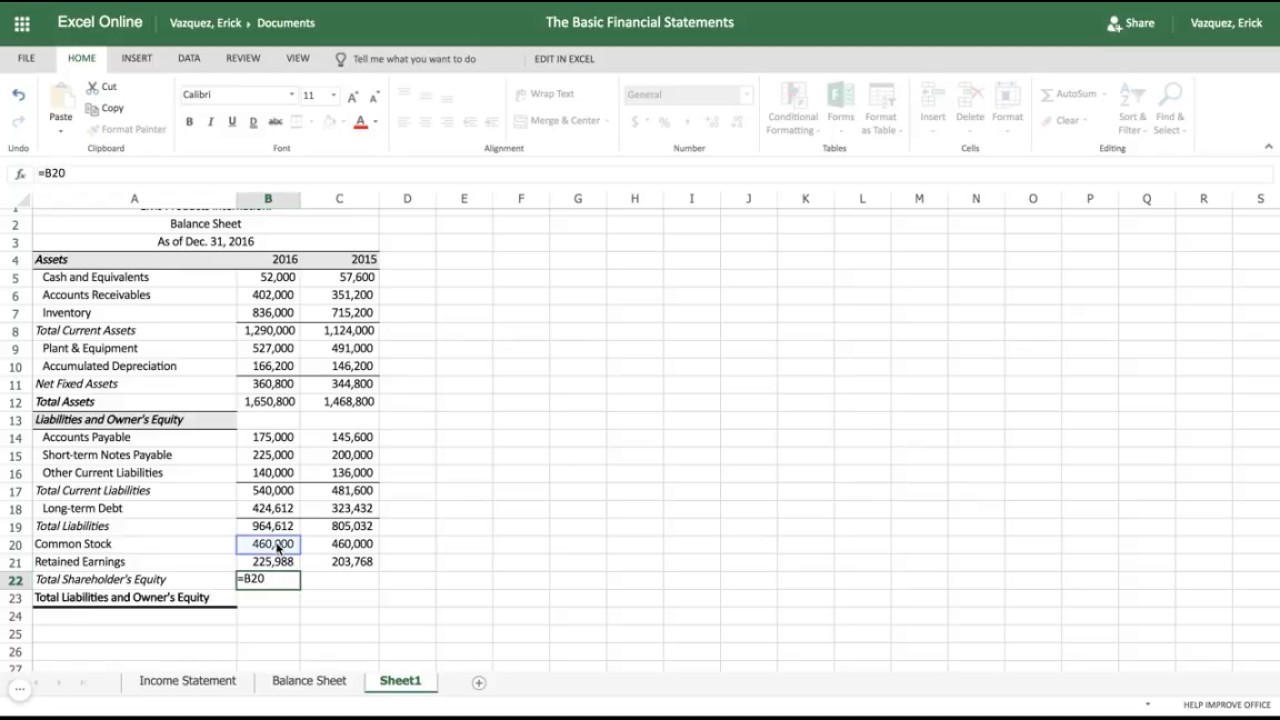

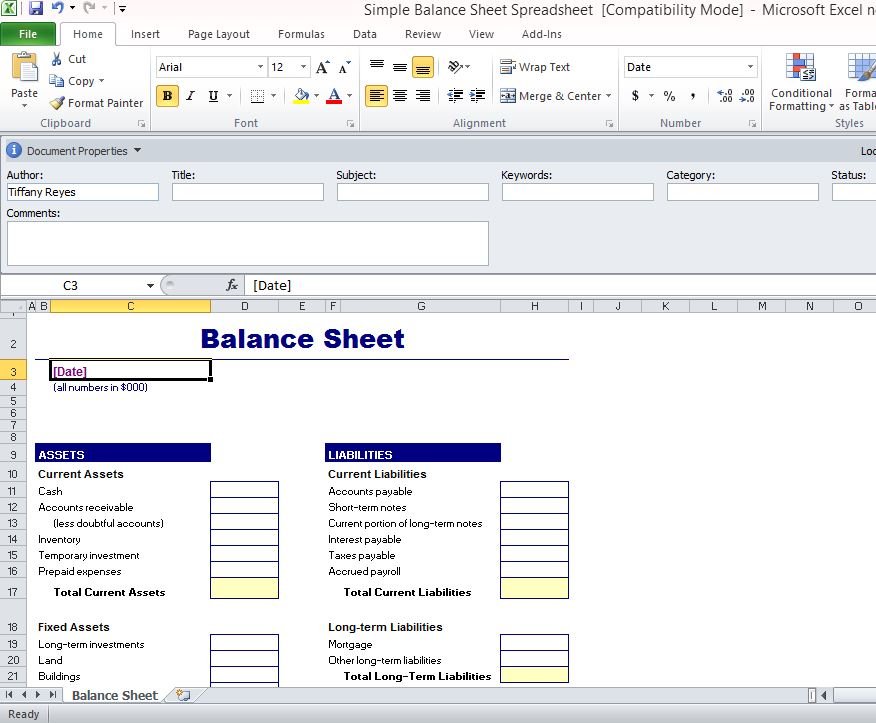

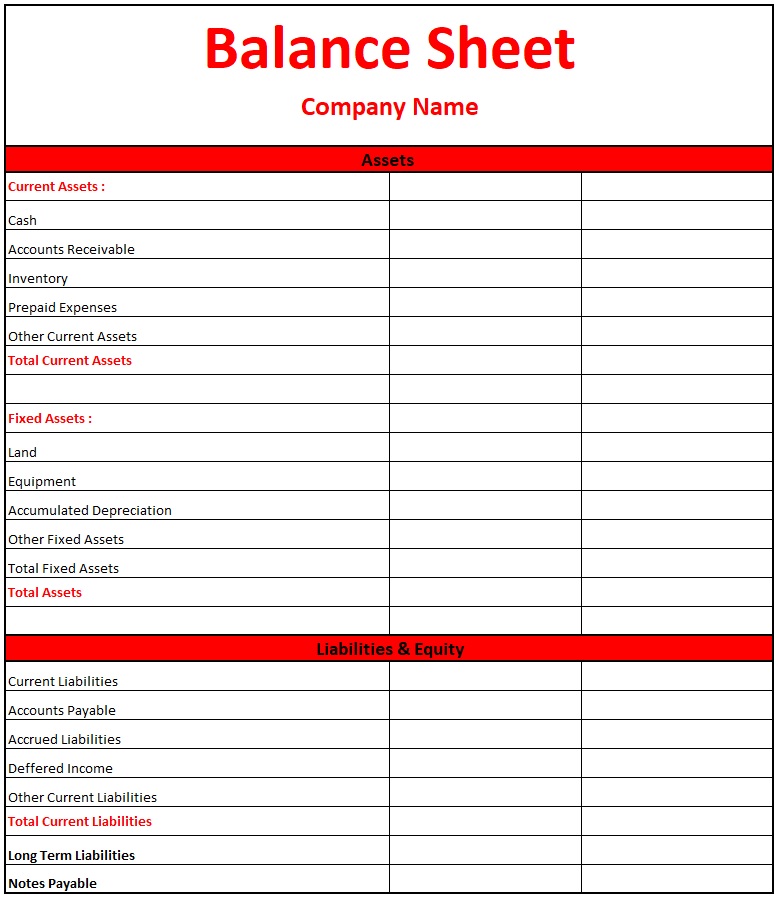

Simple balance sheet excel. What are the three financial statements? To do this, select the e14 cell and write the following formula in the formula bar. Components of a simple small business balance sheet.

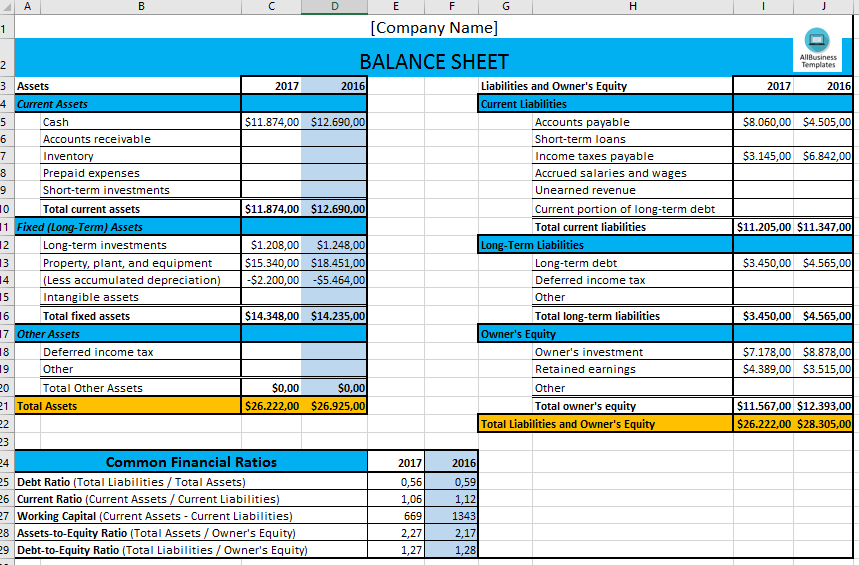

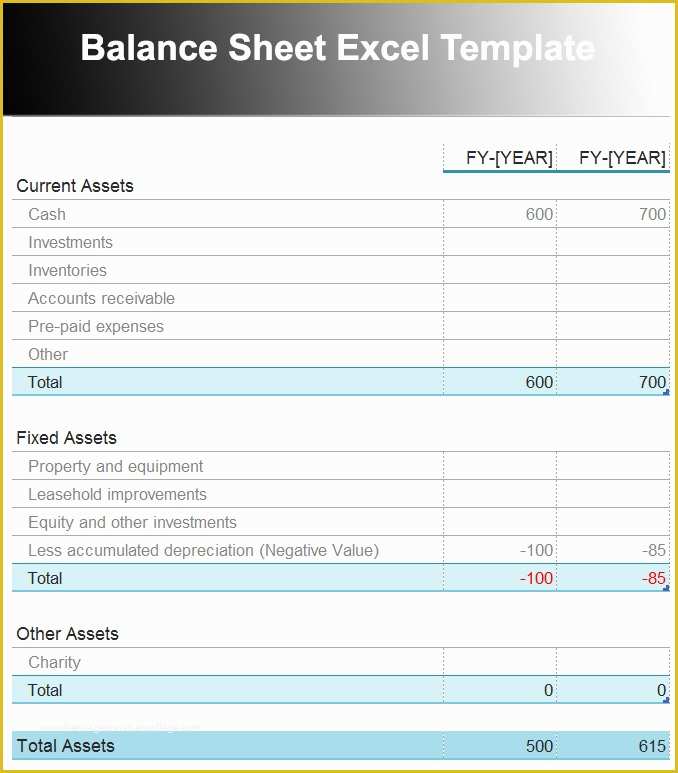

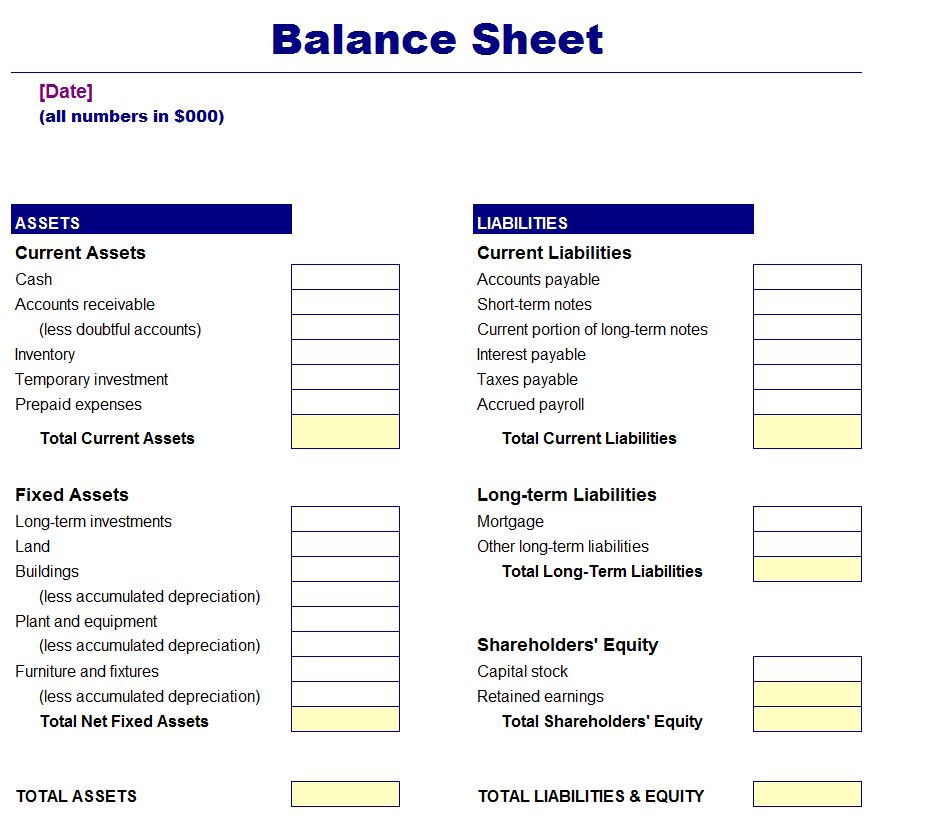

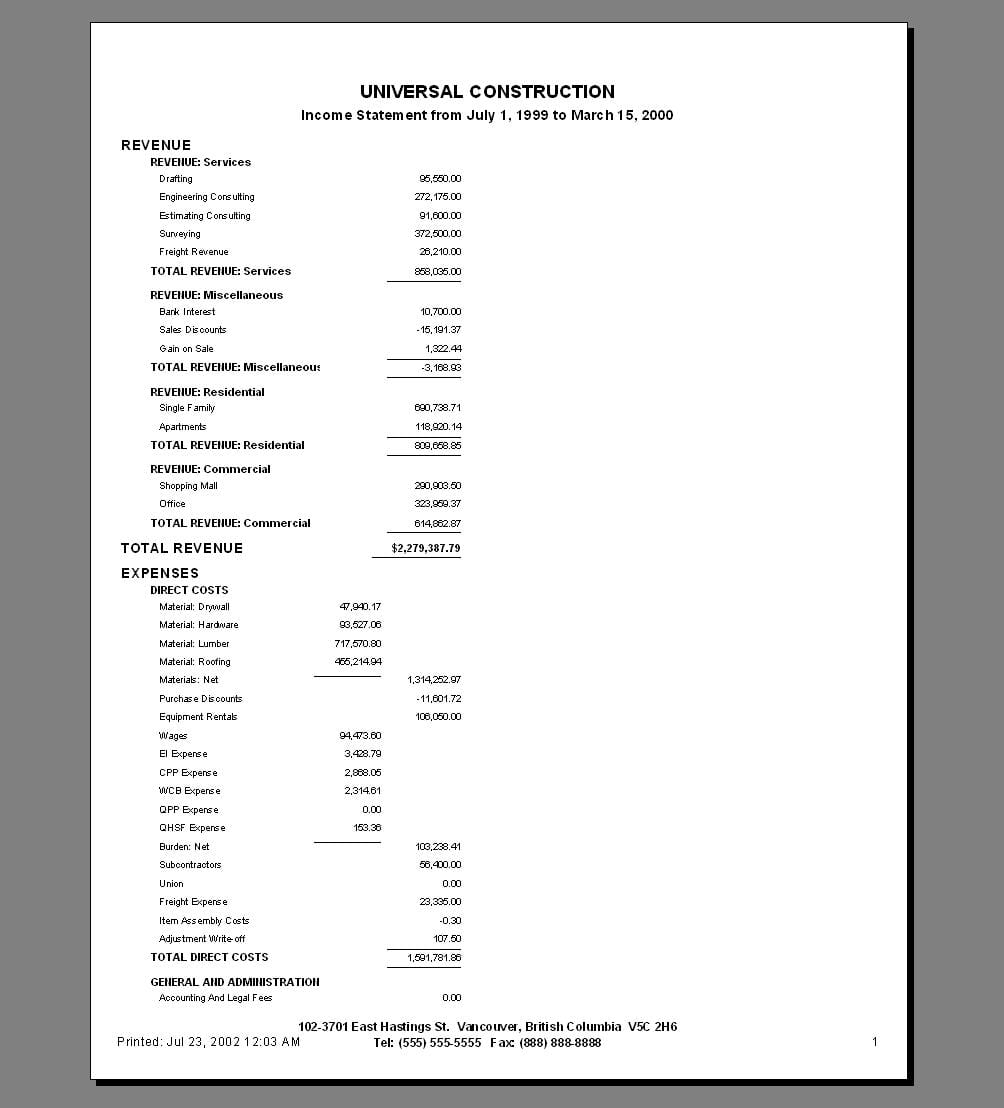

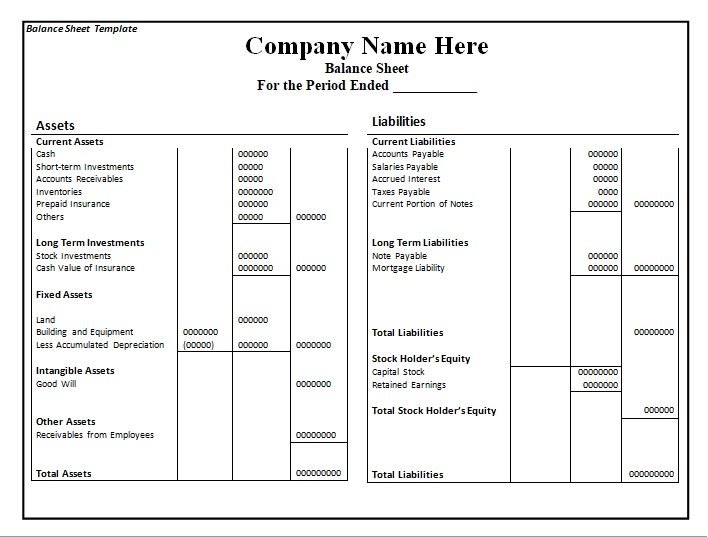

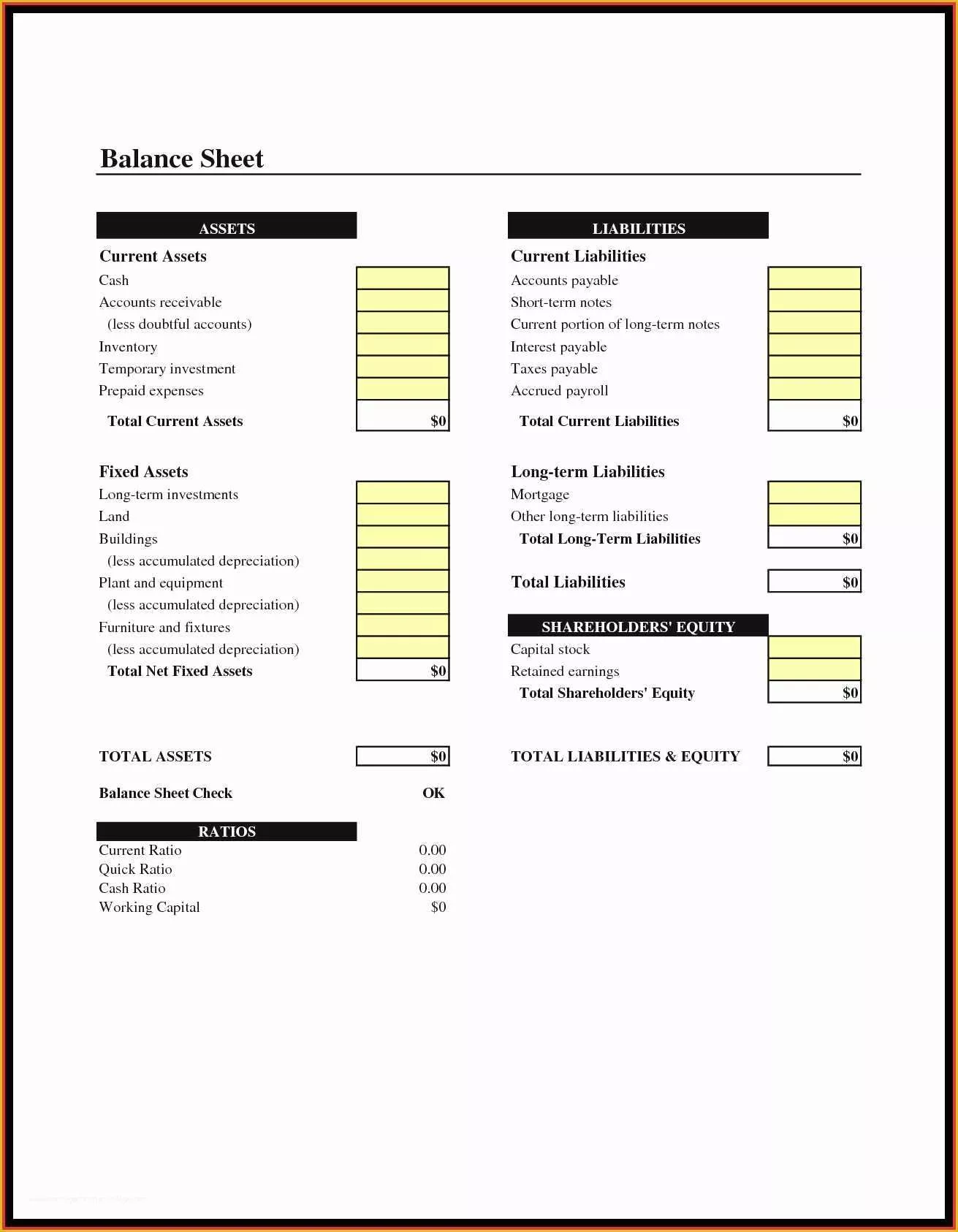

How to calculate financial ratios using excel for balance sheet analysis. The three financial statements are the balance sheet, the profit and loss statement, and the cash flow statement. This free balance sheet template for excel allows you to quickly present your company's assets, liabilities and shareholder equity.

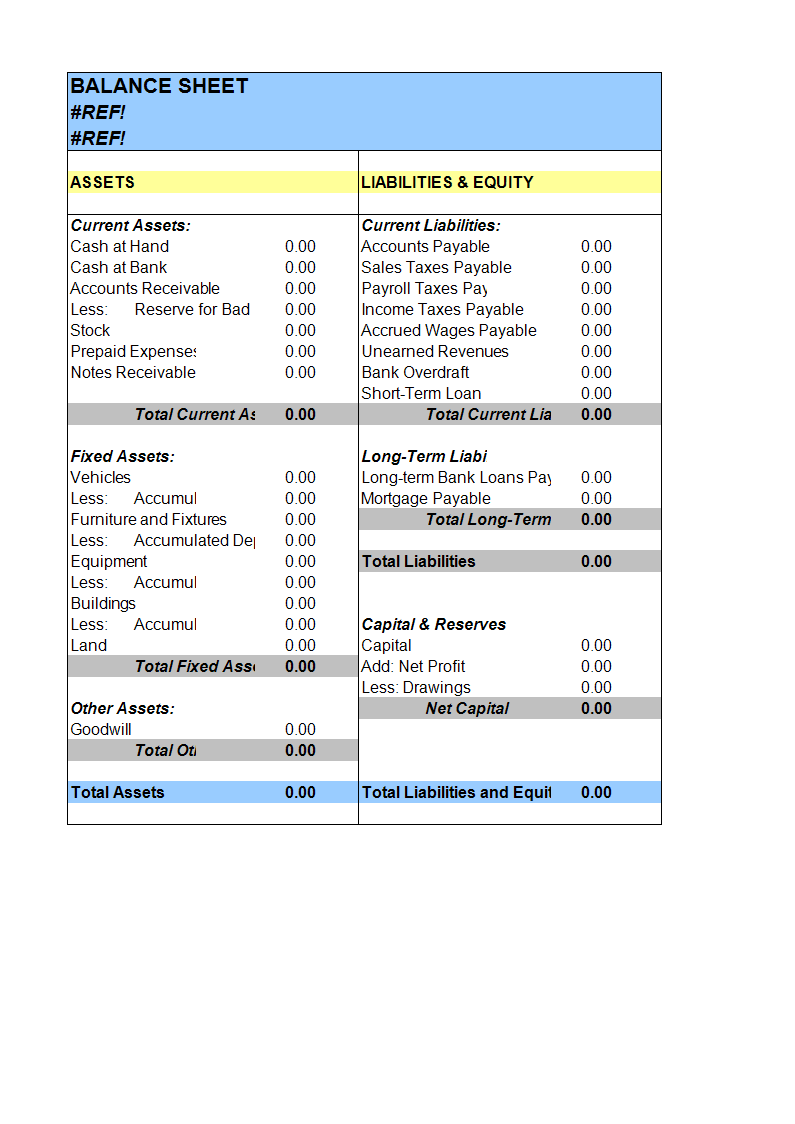

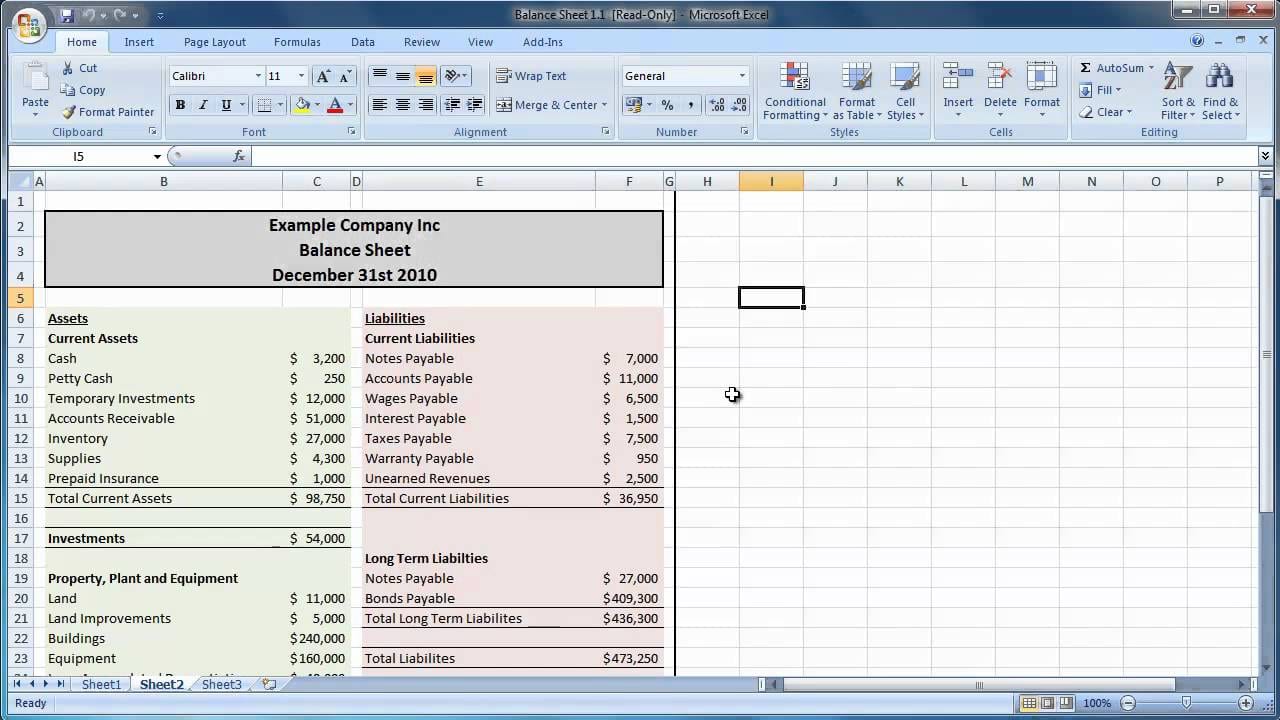

If you're interested in creating effective balance sheets and presenting them to stakeholders, it may be helpful to learn how to create a balance sheet in excel. Assets are the (tangible or intangible) things that a firm owns. The balance sheet describes the assets, liabilities, and equity of a firm at a specific point in time.

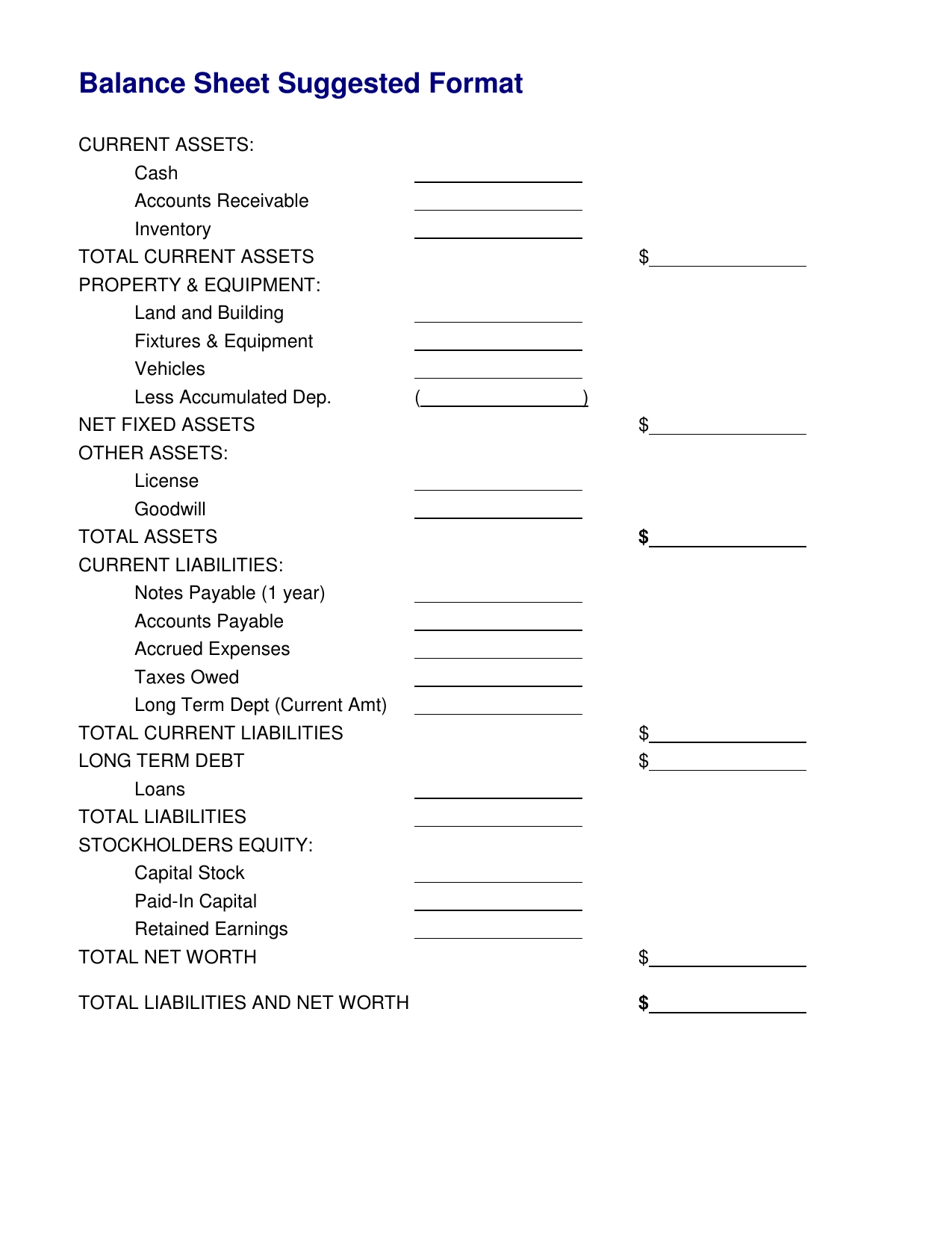

Enter the details of your. Usually, it contains the assets, liabilities, and equities associated with. Create from scratch show all budget your personal and business finances using these templates manage your finances using excel templates.

Next, you will need to calculate the value of the total assets per year. The following excel spreadsheet provides a template of a balance sheet that may be useful for small business accounting. A balance sheet shows the breakdown of your company's assets, liabilities, and equity at.

The fields in the tan colored cells of the. Excel | google sheets | smartsheet. Next, enter the current asset types on the left side and.

Download a basic balance sheet template for. Basic balance sheet template. Identifying key performance indicators (kpis) from your balance sheet analysis.

Here are some steps to follow when creating a simple balance sheet: Stay on track for your personal. Setting the balance sheet up.

A balance sheet contains a summary of the financial amounts of a company or organization.