First Class Info About Zero Based Budget Spreadsheet

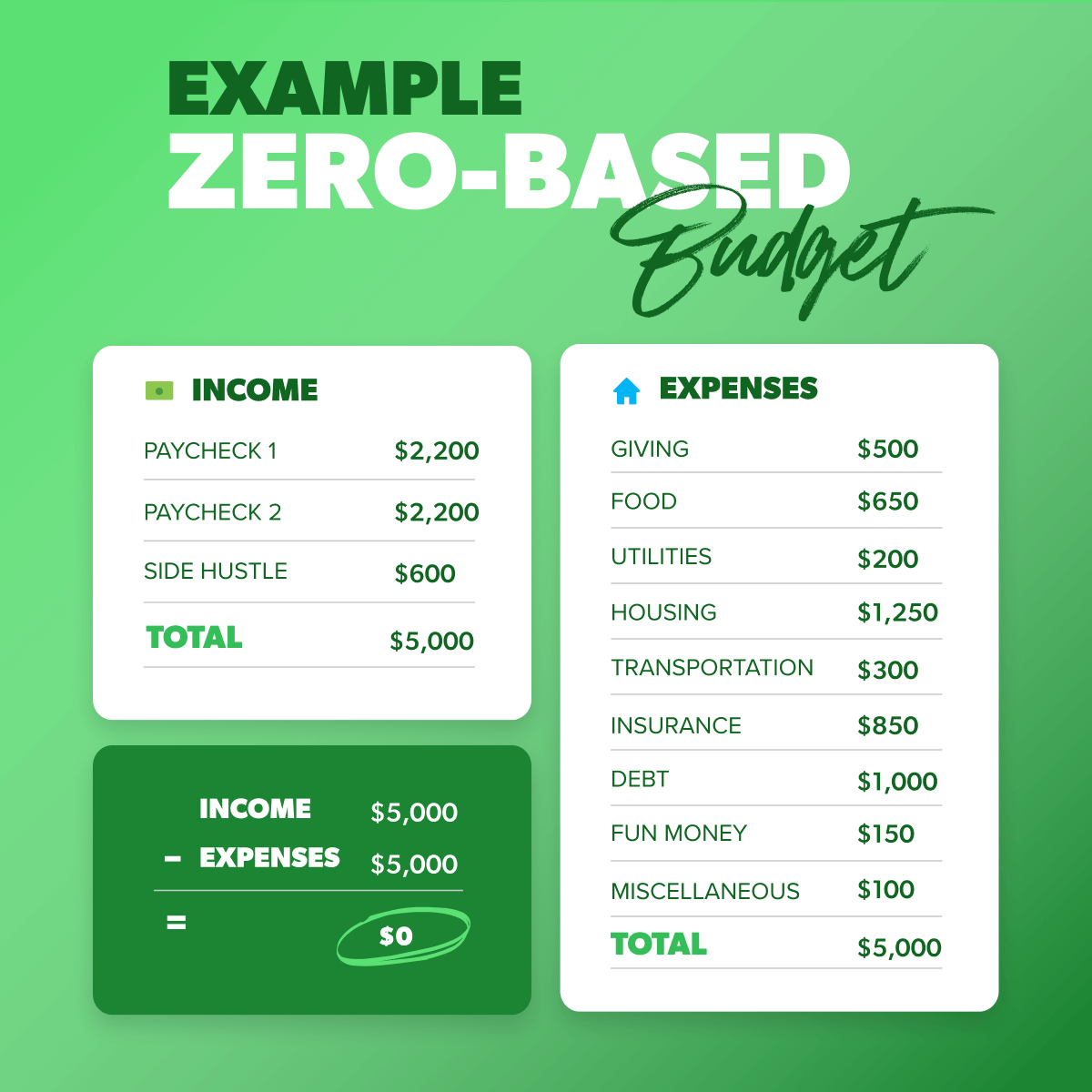

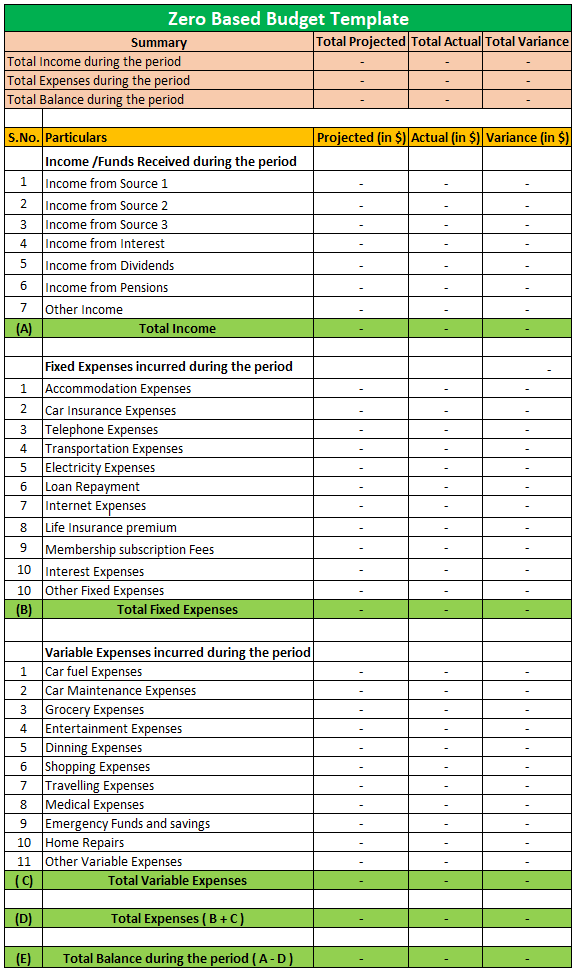

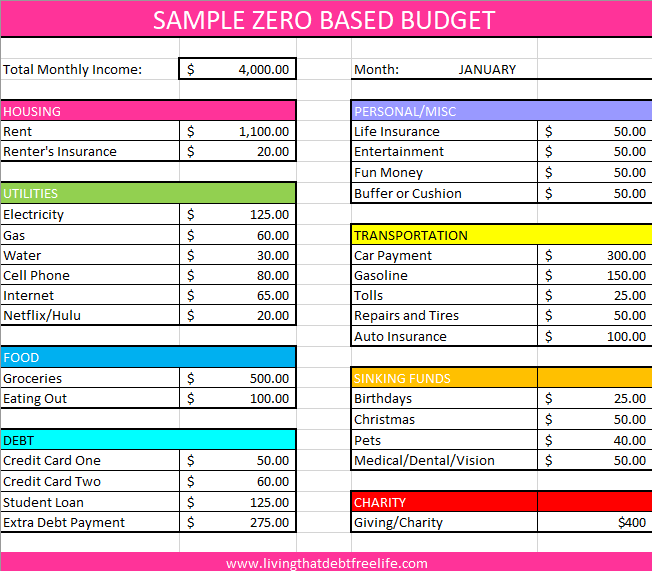

The goal is that your monthly income minus expenses equals zero by the end of the month.

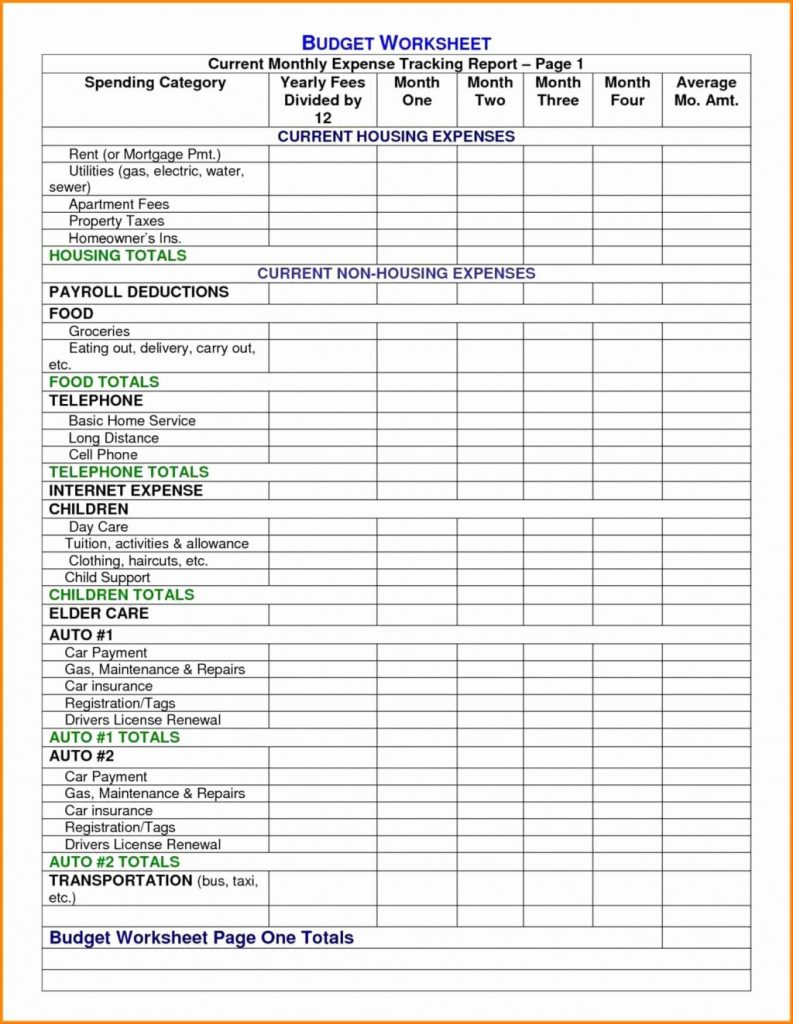

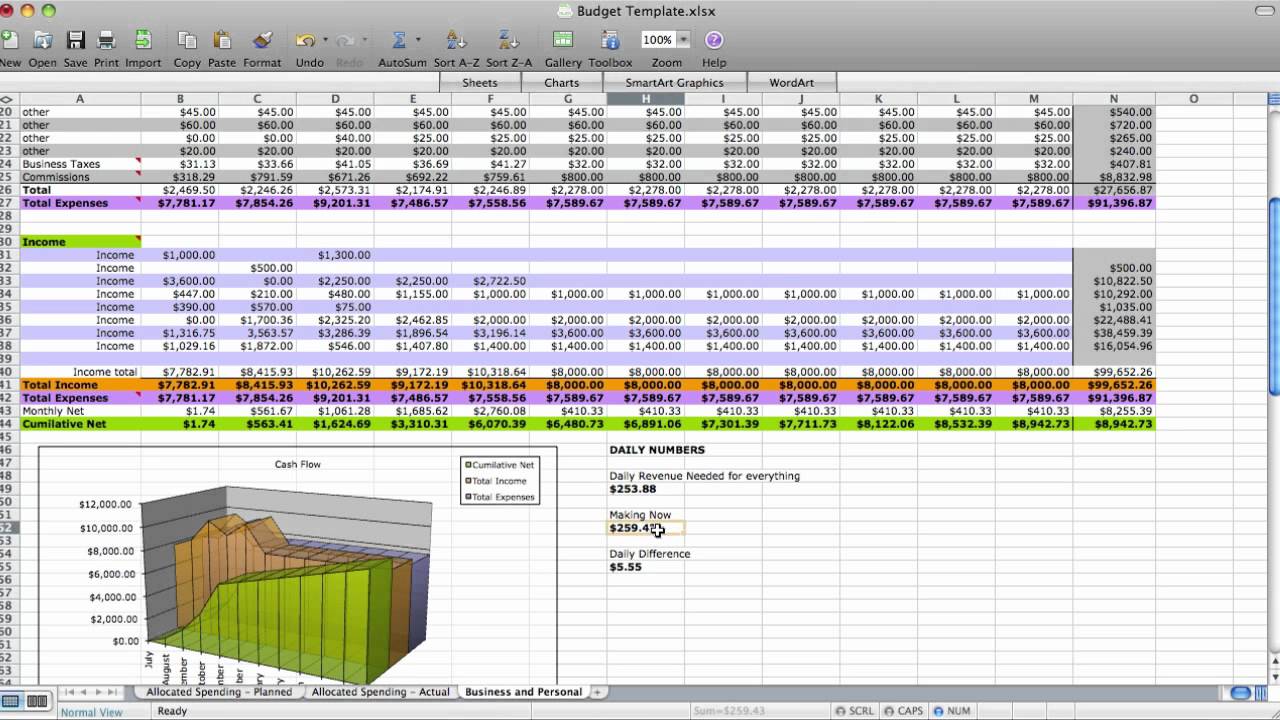

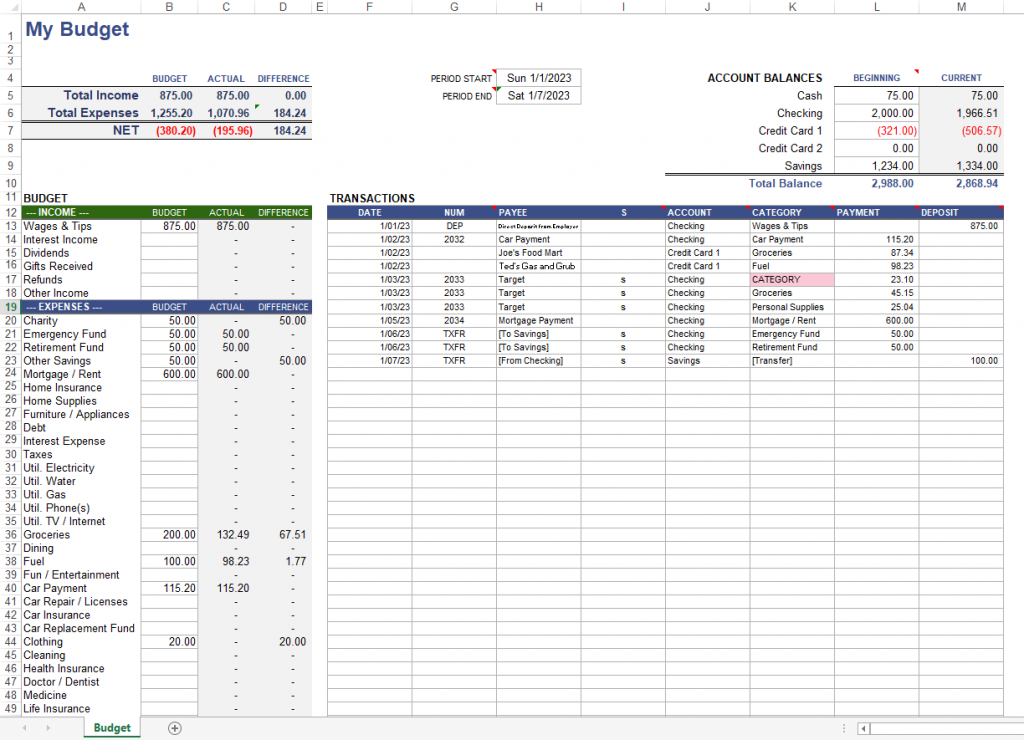

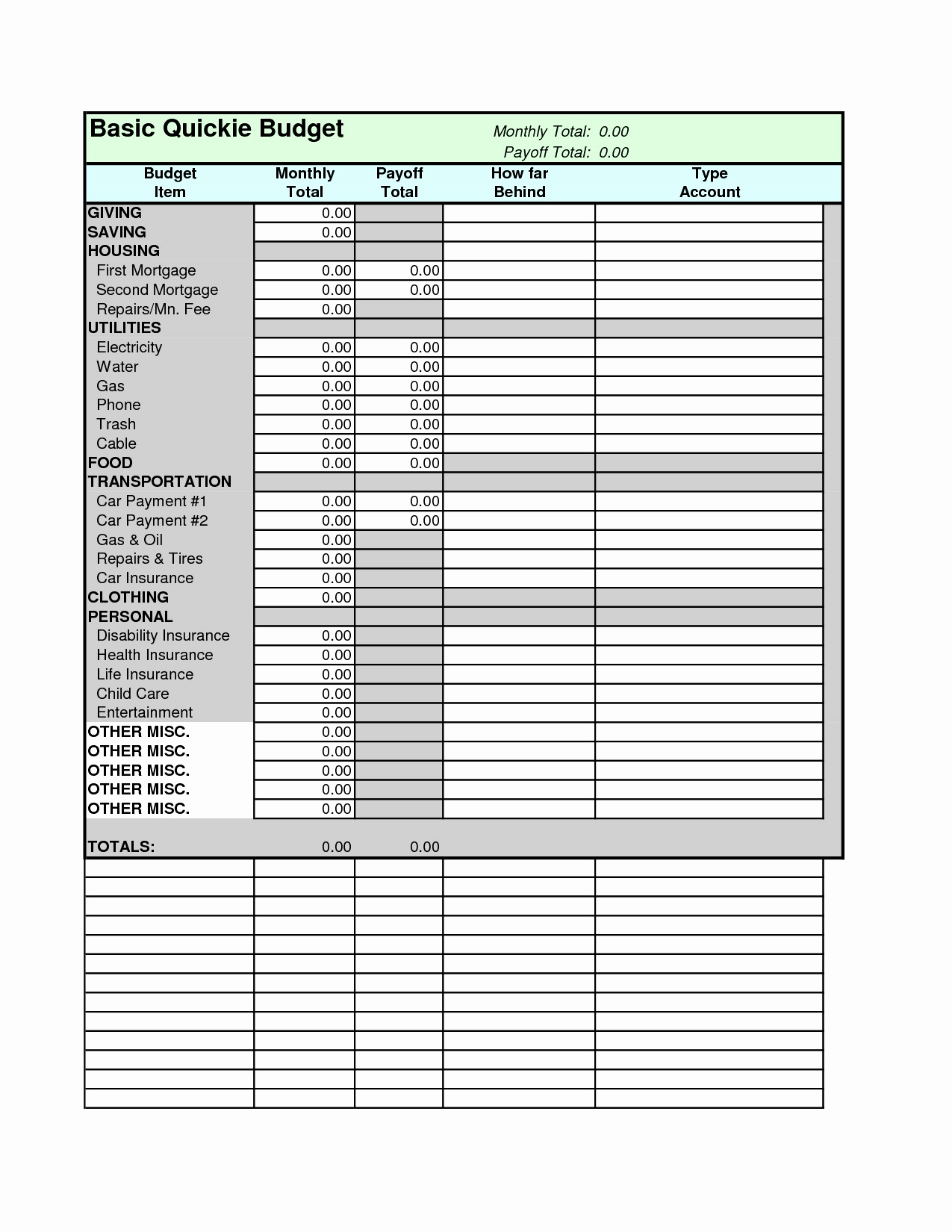

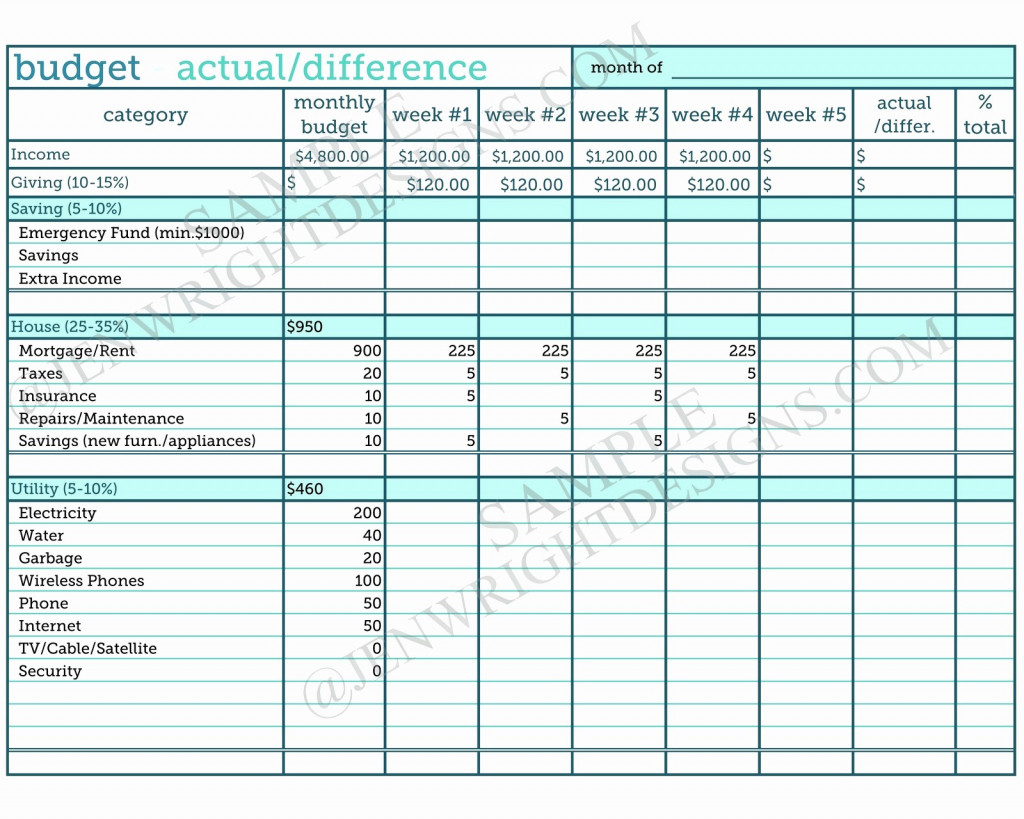

Zero based budget spreadsheet. It comes with all of the formulas to automatically calculate monthly expenses, income, and savings goals. Get expert advice delivered straight to your inbox. Each year, it allows us to reflect on our spending habits and make adjustments to focus on our goals.

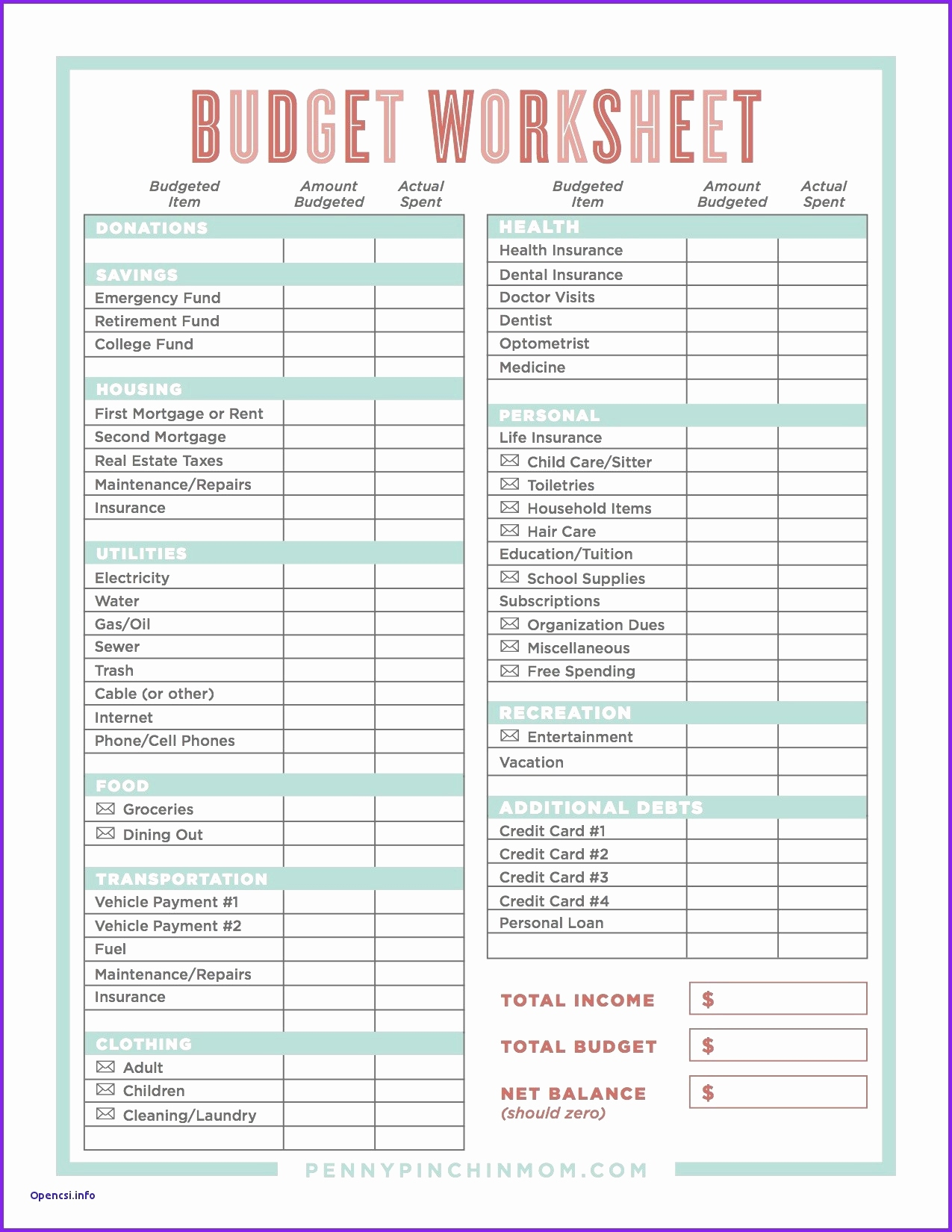

It doesn’t mean you have zero dollars in your bank account at the end of every month. For example, you'd include any income you receive from your job, side hustles, rental properties, alimony, child support, investment income, you name it! Budgeting really is the first step to financial freedom.

Personal use (not for distribution or resale) step 1: This free zero based budget spreadsheet is designed to help you quickly create and maintain a zero based budget. It doesn’t allow for individual transactions, but simply being able to monitor your progress against your plan is helpful.

Determine your monthly expenses 3. You can use your own spreadsheet or a digital system like mint or tiller. Because a budget is a plan for your money —you tell it where to go, so you stop wondering where the heck it went.

Typically this means you will make a plan for. Make changes until the final budget is zero. Determine budgeting time period (month, quarterly, yearly).

Want to pay off a credit card in six months? $0 note that once you've budgeted for the essentials, the other spending categories can be for anything else. Download this template for additional instructions on how.

This budget is also known as the dave ramsey budget and it is very simple to understand. Make a plan for leftover money 4. Calculate your monthly income 2.

This means that total income less total expenses equals zero. Enter your income if you are creating a monthly budget, list all sources of income for the month. This is the zero based budget template that we’ve used since 2014.